FURLOUGHED workers may find themselves unable to get a mortgage through TSB after the lender started listing their salary as just £1.

TSB typically offers a loan of up to 4.5 times an applicant’s wages – meaning furloughed staff may only be able to borrow £4.50 for a new home.

TSB is tightening its mortgage application rules for furloughed workers

The lender says it will only consider furloughed workers if their employer is topping up their salary.

TSB will also accept mortgage applications with a joint partner as long as they “remain affordable” – but again, the person on furlough will have their salary listed as £1.

The furloughed worker will be required to provide proof that their boss is committed to keeping them employed.

TSB says this evidence can be provided in the form of a letter dated within four weeks of the date of the full mortgage application.

The bank has toughened its rules due to fears that furloughed workers are at higher risk of being made redundant.

It’s likely the restrictions will affect thousands of employees in the travel and hospitality industries, which have both been crippled by coronavirus.

TSB says on its website: “As part of our responsible approach in helping customers to borrow well, we no longer accept furloughed income where the customer’s salary isn’t being topped up by their employer.

“For joint applications which remain affordable on the other customer’s income, employment details should be captured and income keyed as £1 for the furloughed customer.

“Where the customer’s employer is topping up their furloughed income to 100 per cent, the employer must provide confirmation that they are committed to ongoing employment.”

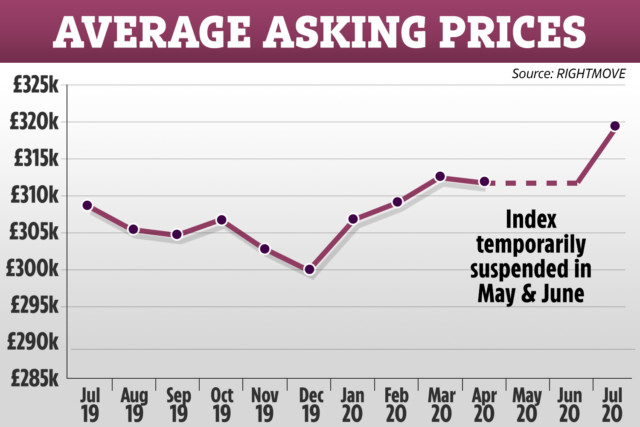

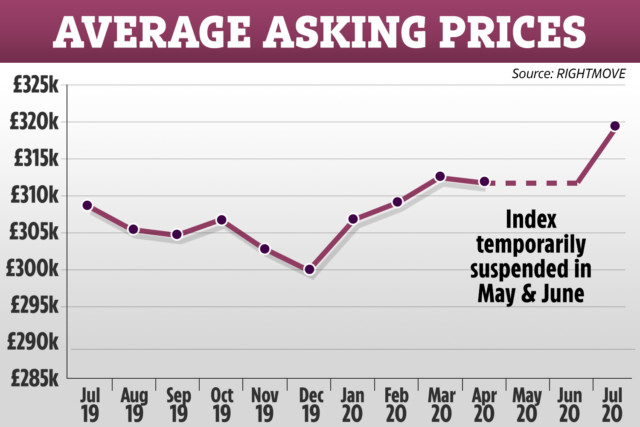

It comes after property asking prices topped £320,000 in a record high due to an “unexpected mini boom” surge in demand.

The average asking price in July stood at £320,265 – 2.4 per cent or £7,640 more than the previous record high in March before lockdown – according to property portal Rightmove.

In March the average asking price was £312,625, which was a record.

Asking prices rose in July to a record high of £320,265, according to Rightmove data

Asking prices rose in July to a record high of £320,265, according to Rightmove data