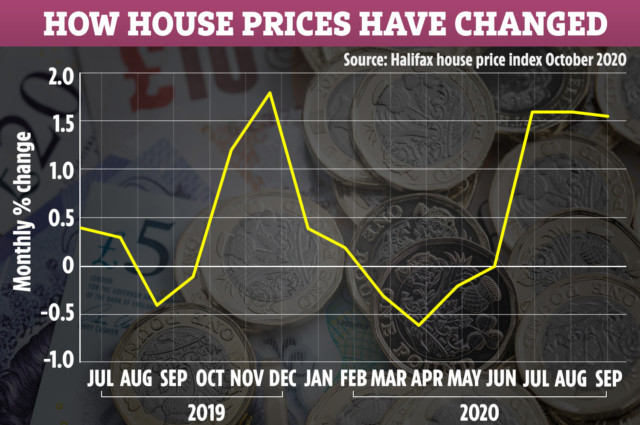

A HOUSING market mini-boom has sent the number of mortgage approvals soaring – and is now at a new 13-year high.

It suggests that the current stamp duty holiday, and pressure to move to larger properties since the lockdown began, is fuelling demand for those looking to move or get on the property ladder.

Bank of England figures and estate agents have revealed there is now a ratio of 13 potential buyers to every available property after house hunter numbers have surged.

The number of mortgage approvals for house purchase continued to increase into September, to 91,500 from 85,500 in August, the Bank of England’s Money and Credit report said.

This was the highest number of approvals since September 2007, and 24% higher than approvals in February this year.

However, the Bank’s figures for remortgaging approvals, which only capture remortgaging with a different lender, show a slight dip compared with August, at 32,700, which is 38% lower than in February this year.

Howard Archer, chief economic adviser to EY ITEM Club, said: “September’s 13-year high for mortgage approvals provides clear evidence of the marked pick-up in housing market activity that has occurred since pent-up demand was released by the easing of restrictions from mid-May onwards.

“This buoyancy has been reinforced by the Chancellor raising the stamp duty threshold to £500,000 from mid-July through to March 31, 2021.”

The figures were released as the National Association of Estate Agents (NAEA) Propertymark said the number of prospective home buyers reached a 16-year high in September.

It said the number of prospective buyers registered per estate agent branch leapt by a third month-on-month.

This was the highest number of house hunters recorded since June 2004.

FIRST TIME BUYER WOES

But in a sign that lenders are toughening up on low-deposit mortgages, its figures also show the proportion of sales made to first-time buyers stood at 19% in September – the lowest amount recorded since March 2013.

Many low-deposit mortgages have disappeared from the market during the coronavirus pandemic, amid concerns about jobs uncertainty and the potential for house prices to fall, which could leave some home owners in negative equity.

But in some better news for first-time buyers, Lloyds Bank reintroduced its Lend a Hand mortgage on Thursday.

It aims to help those struggling with a deposit by enabling them to borrow up to 100% of a mortgage with family support.

The Lend a Hand mortgage has a three-year fixed rate at 3.25%.

It comes after a new mortgage deal was announced aimed at helping first-time buyers onto the property ladder that lets up to six family members or friends apply for a loan.

The Home Booster mortgage from start-up lender Generation Home lets multiple people apply for the same mortgage to increase the amount that can be borrowed.

The idea is this will either help groups of friends who want to live together or it will help first-time buyers struggling to get a big enough mortgage on their own.

Instead of a deposit, a family member stumps up 10% of the purchase price as security in a linked savings account, which earns interest. The savings and interest are released after three years, provided all the mortgage payments have been kept up with.

Mark Hayward, chief executive of NAEA Propertymark, said: “The pressure of completing sales ahead of the stamp duty holiday deadline means we’ve seen a large spike in buyers and sellers coming to the market – with an average of 13 buyers to every available property.

“This boom has been hugely beneficial for the housing market.

“However, with a stamp duty cliff edge on March 31, we are calling on Government to rethink these timings due to the increased pressure on service providers within the industry which is causing delays for buyers and sellers.

“Failure to find a solution to the cliff edge, whether that be a taper or extension, could cause thousands of sales to fall at the final hurdle and have a knock-on and drastic effect on the housing market which has recovered well from the Covid slump.”