Internal Tensions Rise Within Labour Party

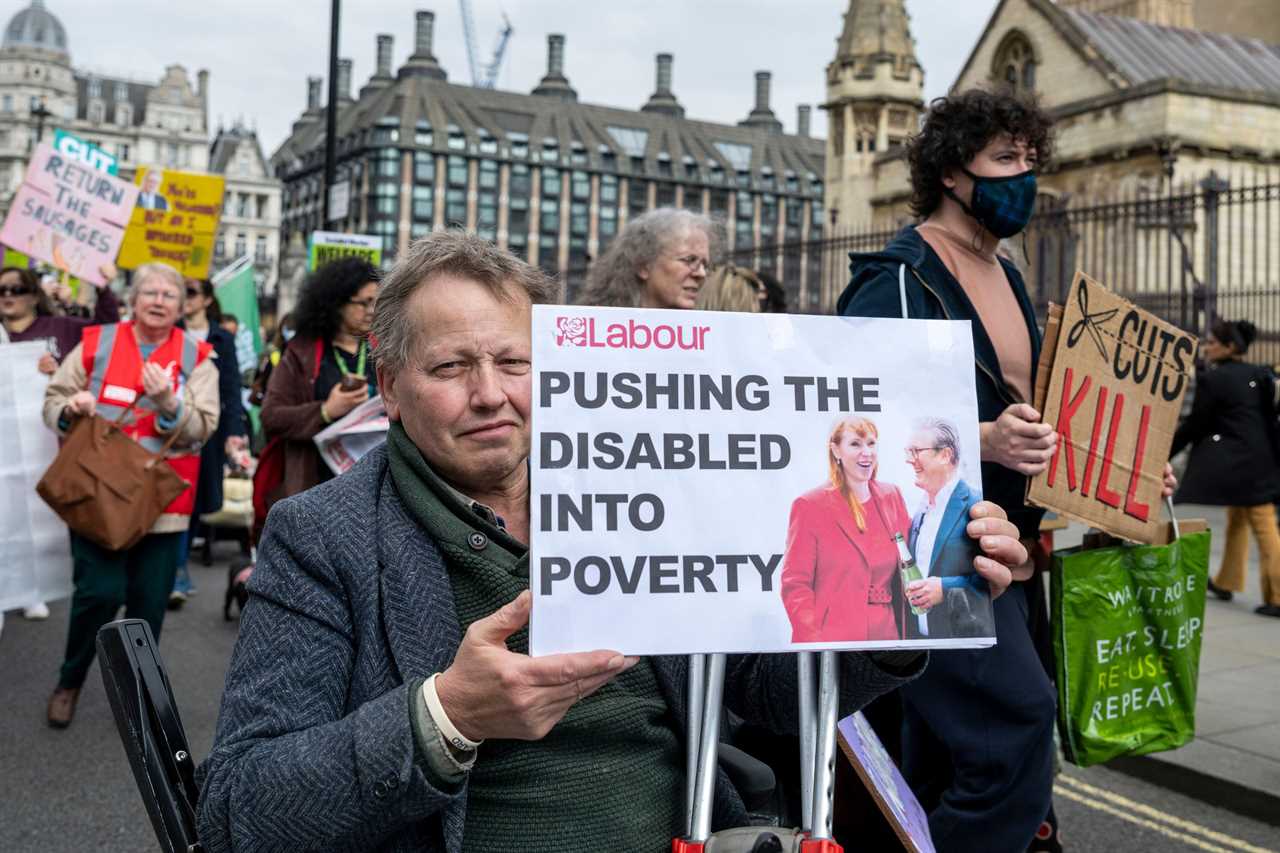

Rachel Reeves is facing significant backlash from her own party as revelations surface that her latest benefits overhaul could push 250,000 individuals, including 50,000 children, into poverty. This internal strife highlights deep divisions within the Labour Party regarding the current economic policies and their social implications.

Details of the Benefits Reduction Plan

The Chancellor has implemented a series of stringent measures aimed at addressing a £1.6 billion shortfall. Key among these is the freezing of the Universal Credit health top-up at £50 per week for new applicants. Additionally, the standard rate rise has been slashed to £106, a move that has drawn widespread criticism. These adjustments are part of an effort to stabilize the government's finances amid mounting fiscal pressures.

Widespread Impact on Vulnerable Households

According to government analysis, the proposed changes will have severe repercussions for millions of households. Approximately 370,000 people will lose their Personal Independence Payments (PIP), while around 2.25 million will see their health-related support halted. On average, more than 3 million households are expected to lose £1,720 annually, exacerbating financial hardships for many families across the country.

Government's Justification and Economic Strategy

In an attempt to justify the cuts, Treasury Minister Darren Jones made an analogy comparing the measures to taking away children’s pocket money, a statement that has been widely criticized for its insensitivity. Despite the backlash, Reeves remains steadfast, asserting that her £1 billion jobs support package will ultimately help lift families out of poverty. She maintains that the projected figure of 250,000 affected individuals assumes no one reenters the workforce, suggesting that job creation is key to mitigating the negative impacts of the benefits cuts.

Labour MPs Condemn the Reforms

Labour MP Debbie Abrahams has been vocal in her opposition, arguing that the proposed reforms will lead to deteriorating health outcomes. The potential loss of vital support services could place additional strain on public health systems and increase the burden on healthcare providers. Abrahams and other dissenting MPs warn that the cuts will disproportionately affect the most vulnerable, undermining efforts to achieve social equity and economic stability.

Reeves' Confidence in Economic Measures

Despite the growing discontent, Rachel Reeves remains confident in her strategy, emphasizing that the job support package is designed to provide long-term solutions for poverty alleviation. She contends that by fostering employment opportunities, the government can create a sustainable path out of financial hardship for the affected populations. However, critics within her party question the feasibility of these projections, fearing that the immediate consequences could outweigh the anticipated benefits.

Looking Ahead: The Future of Labour's Internal Debate

The unfolding situation presents a critical juncture for the Labour Party, as it grapples with balancing fiscal responsibility and social welfare. The impending votes from numerous Labour MPs signal a potential schism that could influence the party's direction and policy priorities moving forward. As discussions continue, the outcome will likely have significant implications for both the party's cohesion and its ability to address the nation's economic challenges effectively.

Public Reaction and Broader Implications

Beyond the party lines, the proposed benefits cuts have sparked conversations among the general public about the government's approach to welfare and economic management. Advocacy groups and community leaders are voicing their concerns, urging the government to consider more humane and comprehensive solutions to poverty. The debate underscores the complex interplay between austerity measures and the imperative to protect vulnerable populations in times of economic uncertainty.

Conclusion: Navigating Economic Policies in Turbulent Times

As Rachel Reeves faces mounting opposition from within her party, the broader conversation about effective economic policies and social support systems continues to evolve. The challenge lies in finding a balance between addressing fiscal deficits and ensuring that the most vulnerable members of society are not left behind. The outcome of this internal Labour debate will be instrumental in shaping the future direction of the party and its ability to respond to the nation's economic needs.

Frequently Asked Questions

How does inflation affect the value of money?

Inflation refers to the general rise in prices over time, which erodes the purchasing power of money. As inflation increases, each unit of currency buys fewer goods and services, meaning that the value of money decreases in terms of what it can purchase.

What are the risks associated with investing in the stock market?

Investing in the stock market involves several risks, including market volatility, economic downturns, and company-specific factors that can lead to losses. Investors may also face liquidity risk, where they cannot sell an investment quickly without incurring a loss. Diversification and thorough research can help mitigate these risks.

What is the definition of money?

Money is a medium of exchange that facilitates transactions for goods and services. It serves as a unit of account, a store of value, and a standard of deferred payment, allowing individuals to compare the value of diverse products and services.

What is a budget deficit?

A budget deficit occurs when a government's expenditures exceed its revenues over a specific period, usually a fiscal year. This can lead to increased borrowing and national debt if not addressed through spending cuts or revenue increases.

What are the different types of money?

The main types of money include commodity money, which is based on physical goods like gold or silver; fiat money, which is government-issued currency not backed by a physical commodity; and digital currency, which exists electronically and is often decentralized, such as cryptocurrencies.

What are the benefits of having an emergency fund?

An emergency fund provides financial security by offering a safety net for unexpected expenses, such as medical emergencies or job loss. It helps prevent debt accumulation, reduces stress, and allows for better financial planning, ensuring that individuals can navigate unforeseen circumstances without significant hardship.

What is the difference between saving and investing?

Saving typically involves setting aside money in a secure account for short-term needs or emergencies, while investing involves using money to purchase assets like stocks or real estate with the expectation of generating a return over the long term. Investing carries higher risks but offers the potential for greater rewards.

Statistics

- A report by Bankrate indicated that only 29% of Americans have a written financial plan.

- As of 2021, the average American household had approximately $8,400 in credit card debt, according to Experian.

- According to a Gallup poll, 56% of Americans report that their financial situation is better than it was a year ago.

- The average cost of raising a child in the U.S. is estimated to be around $233,610, according to the U.S. Department of Agriculture.

- In 2020, the average retirement savings for Americans aged 60 to 69 was approximately $195,000, according to Fidelity.

- A survey by the American Psychological Association found that 72% of Americans reported feeling stressed about money at some point in the past month.

- According to the Bureau of Labor Statistics, the average American spends about $1,500 per year on coffee.

- According to a survey by the Financial Industry Regulatory Authority (FINRA), about 66% of Americans could not correctly answer four basic financial literacy questions.

External Links

How To

How To Plan for Major Expenses

Planning for major expenses requires careful thought and budgeting. Start by identifying upcoming significant costs, such as home repairs, medical expenses, or a new vehicle. Research the estimated costs associated with these expenses, and create a timeline for when the payments will be due. Develop a savings plan by determining how much you need to set aside each month to meet your goal by the target date. Consider using a high-yield savings account to earn interest on your savings. Regularly review and adjust your plan as needed, ensuring you stay on track to meet your financial obligations without incurring debt.

Did you miss our previous article...

https://hellofaread.com/money/aldis-new-garden-essentials-offer-big-savings-this-spring

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions