LIZ Truss and Kwasi Kwarteng yesterday gambled on a £45billion tax giveaway and a £60billion energy bills freeze in a bid to jump-start the economy.

Serving up the biggest tax cuts in half a century, the new Chancellor vowed to hit 2.5 per cent growth every year.

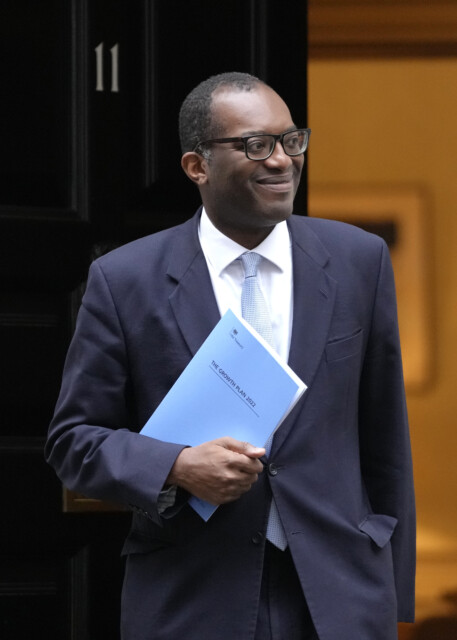

Chancellor Kwasi Kwarteng with his blueprint for growth outlined in the mini Budget

Serving up the biggest tax cuts in half a century, the new Chancellor, with Liz Truss, vowed to hit 2.5 per cent growth every year

In an astonishing break from the past 12 years of Conservative rule, Mr Kwarteng promised: “We will turn the vicious cycle of stagnation into a virtuous cycle of growth.”

Initially dubbed a “mini Budget”, his Growth Plan ended up being the most radical slashing of taxes since 1972. But some economists have warned that it could make things even worse.

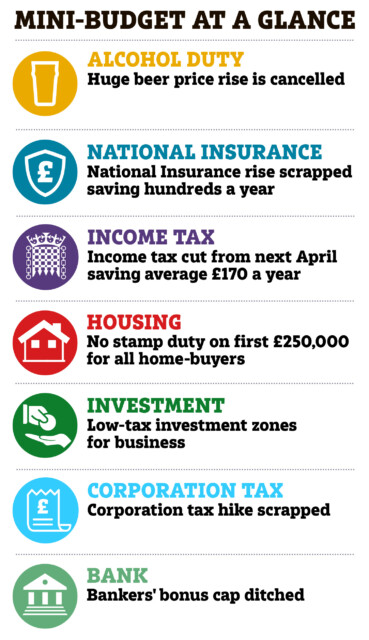

Some 31 million workers will get a penny off income tax next April — with the 600,000 highest earners given a massive cut after the shock abolition of the 45p top rate of tax.

Ripping up ex-Chancellor Rishi Sunak’s previous National Insurance hike means the average worker will also get an extra £330 a year from next month.

And no home sold for less than £250,000 will pay stamp duty — which covers a third of all properties on the market. In a big win for first time buyers, that threshold will rise from £300,000 to £425,000.

The Treasury insists the huge cuts will be paid for over time by the economic growth they create. But the Pound plunged last night amid fears of massive borrowing.

The Chancellor said: “We will deliver higher wages, greater opportunities, and fund public services, now and into the future. That is how we will compete successfully with dynamic economies around the world.”

Labour accused the Government of a “desperate gamble” with the nation’s finances.

To help vulnerable households with soaring energy costs, a price cap will freeze bills at £2,500 from October 1 for two years. The first six months of the cap alone will cost the Government £60billion.

But Mr Kwarteng insisted: “The Prime Minister has acted with great speed to announce one of the most significant interventions the British state has ever made. People need to know that help is coming. And help is indeed coming.”

A planned rise in corporation tax due next April was also axed.

And the cap on bankers’ bonuses, introduced by the EU in the aftermath of the 2007-2008 financial crash, was scrapped, too.

To boost tourism, foreigners will be able to claim back VAT on duty free goods they buy in Britain.

The Chancellor hopes his tax plans and other incentives will lure the rich to London over rivals New York, Paris and Frankfurt.

He told the Commons: “We need global banks to create jobs here, invest here, and pay taxes here.”

Mr Kwarteng also lit a bonfire of red tape and planning laws for swathes of Britain which will become “investment zones”.

These 38 low tax areas will see firms that employ new workers given a £50,000 National Insurance holiday and the green light to rapidly build new homes and offices.

The sweeping cuts and energy hand-outs will be funded mostly by borrowing an additional £72billion — taking borrowing this year £234billion.

Mr Kwarteng last night admitted the economy is “technically” in recession, but hoped it would be a “shallow” slump”.

Tory MP and ex-Cabinet minister Julian Smith said the huge tax cut for the rich at a time of national financial crisis is “wrong”. And experts warned the Chancellor’s plan could risk crashing the economy if investors lose faith in the Government’s stewardship.

The Institute of Fiscal Studies accused Mr Kwarteng of putting national debt on an “unsustainable rising path” and said his plans were delivered “without even a semblance of an effort to make the public finance numbers add up”.

Labour’s Shadow Chancellor Rachel Reeves said it was “one last throw of the dice” by the Government after 12 years of Tory rule.

But the National Institute of Economic and Social Research said the plan will lead to positive GDP growth for the last three months of this year — shortening any recession and raising growth to around two per cent over 2023-24.

Richest get best return

THE richest will gain most from the Budget, according to experts.

The Resolution Foundation said half the tax cut gains will go to the richest five per cent, who will be £8,560 better off.

Just 12 per cent will go to the poorest half of households, who will be £230 wealthier.

The Foundation said the cuts, along with the reversal of the National Insurance hike and end to the cap on bankers’ bonuses, were aimed at the “very richest in society”.

The Treasury said it was trying to “show the size of the pie so that everybody benefits”.

Fuel duty frustration

DRIVERS lashed out after they were left out of the Budget. The 5p fuel duty cut is due to expire in March and motorists are begging the Chancellor to keep it.

Howard Cox of FairFuelUK blasted: “Liz Truss and Kwasi Kwarteng should hang their fiscal heads in shame by not cutting fuel duty. Frankly, this is the economics of an asylum.”

Kwarteng hinted to MPs that he may look at it again in the full Budget expected in November. It came as AA research showed the weak pound is costing drivers up to fiver a tank.

Business is in the zone

NEW investment zones across the country will offer businesses big tax cuts and relaxed planning restrictions.

Firms will benefit from business rates, stamp duty and National Insurance relief to fire up their local economy.

Red tape will be slashed so that development projects can be accelerated.

Ministers are already in talks with 38 English local authorities about becoming enterprise hubs.

Mr Kwarteng hailed the “unprecedented set of tax incentives for business to invest, to build, and to create jobs right across the country”.

Wind ban blown out

A BAN on onshore wind farms is to be ripped up, risking a huge war with Nimby Tory MPs.

Ministers have vowed to bring wind planning policy in line with other rules to make it easier to build huge farms in England.

None has had the green light since 2015 when the then-PM David Cameron tightened rules.

Even offshore ones can take four years to get through.

Renewable wind is up to ten times cheaper than gas.

But MPs are likely to oppose bids to build the ugly infrastructure in their backyards.