Widespread Outages Leave Thousands Frustrated

Customers of Nationwide have been left exasperated after the building society's services reportedly went offline earlier today. The sudden disruption has made it impossible for many users to access their accounts, sparking a wave of complaints across social media platforms.

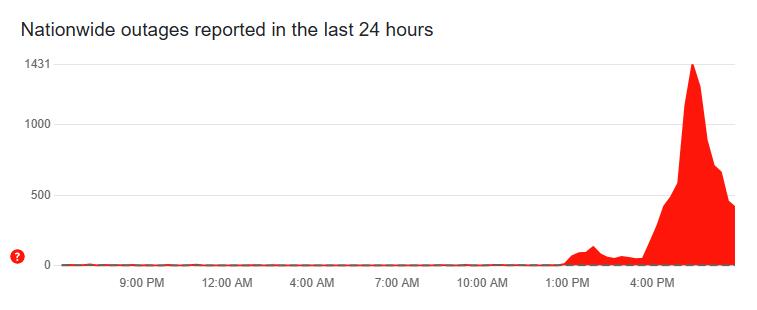

Downdetector Reports Surge in Service Failures

According to Downdetector, nearly 1,500 issues were reported with Nationwide’s services shortly after 5pm on Sunday. The majority of these complaints pertained to mobile banking, accounting for 58 per cent of the total reports. Online banking failures followed closely, making up 39 per cent of the issues, while credit card usage problems comprised the remaining 4 per cent.

Customers Voice Their Frustration Online

Many Nationwide users took to platforms like X (formerly Twitter) to express their dissatisfaction. One user lamented, “Once again Nationwide down with bank transfers got direct debits due tomorrow and need to transfer money.” Another added, “Nationwide gone down and it won’t even let you pay for anything… how on earth do you expect us to buy food.”

Essential Payments at Stake

The service outage has left numerous customers unable to make crucial payments, raising concerns about potential late fees and financial penalties. One frustrated individual questioned, “If I’m fined late payment will Nationwide cover?” Meanwhile, others highlighted the immediate impact on their ability to pay bills and manage daily expenses.

Nationwide Remains Silent on the Outage

As of now, Nationwide has not provided any official statement regarding the service disruption. The building society has yet to address the growing number of complaints or offer an estimated time for the restoration of services.

Recent Changes to Branch Opening Hours Add to Tensions

The service blackout comes just days after Nationwide announced significant changes to the opening hours of 12 high street branches, effective from April 14. These adjustments involve shifting the usual closure days to different points in the week. For instance, the Bangor branch in Wales will now be closed on Fridays instead of Wednesdays, altering its operating hours from 9am to 4.30pm, Monday through Friday.

Impact on Local Branches

Similarly, the Reigate branch in Surrey will change its midweek closures from Wednesday and Thursday to Monday and Wednesday. This means the branch will be open Tuesday, Thursday, and Friday, rather than the previous schedule. In Kendall, the branch will adjust its closures from Wednesday and Friday to Monday and Friday, ensuring it operates on Tuesday, Wednesday, and Thursday.

Nationwide's Commitment to Branch Presence

A spokesperson for Nationwide stated, “We remain committed to our branch promise that everywhere we have a branch we will remain until at least the start of 2028. We continually review branch opening days and hours based on customer demand and we are pleased to be increasing opening hours overall. For individual branch opening hours, please see our branch finder on our website.”

Customers Await Clarification Amidst Service Chaos

With the recent service outage and the impending changes to branch operations, Nationwide customers are left seeking clarity and reliable banking solutions. The simultaneous challenges highlight the critical need for robust and dependable banking services, especially during times of transition.

Frequently Asked Questions

What is the definition of money?

Money is a medium of exchange that facilitates transactions for goods and services. It serves as a unit of account, a store of value, and a standard of deferred payment, allowing individuals to compare the value of diverse products and services.

How can I budget my money effectively?

To budget effectively, start by tracking your income and expenses to understand your spending habits. Set realistic financial goals, categorize your expenses, and allocate funds accordingly. Regularly review and adjust your budget to ensure it reflects your current financial situation and objectives.

What is the role of central banks in the economy?

Central banks manage a nation's currency, money supply, and interest rates. They implement monetary policy to control inflation, stabilize the currency, and foster economic growth. They also serve as lenders of last resort to the banking system during financial crises.

How does inflation affect the value of money?

Inflation refers to the general rise in prices over time, which erodes the purchasing power of money. As inflation increases, each unit of currency buys fewer goods and services, meaning that the value of money decreases in terms of what it can purchase.

What is a budget deficit?

A budget deficit occurs when a government's expenditures exceed its revenues over a specific period, usually a fiscal year. This can lead to increased borrowing and national debt if not addressed through spending cuts or revenue increases.

What are the main functions of money?

The primary functions of money are as a medium of exchange, facilitating trade; a unit of account, which provides a standard measure of value; a store of value, allowing individuals to save and transfer purchasing power over time; and a standard of deferred payment, enabling credit transactions.

What are credit scores and why are they important?

Credit scores are numerical representations of an individual's creditworthiness, calculated based on credit history, payment behavior, and debt levels. They are important because they impact the ability to obtain loans, credit cards, and favorable interest rates, affecting overall financial health.

Statistics

- A survey by the American Psychological Association found that 72% of Americans reported feeling stressed about money at some point in the past month.

- The average cost of raising a child in the U.S. is estimated to be around $233,610, according to the U.S. Department of Agriculture.

- A report by Bankrate indicated that only 29% of Americans have a written financial plan.

- As of 2021, the median household income in the U.S. was approximately $67,521, according to the U.S. Census Bureau.

- As of 2021, the average student loan debt for recent graduates was approximately $30,000, according to the Federal Reserve.

- According to a Gallup poll, 56% of Americans report that their financial situation is better than it was a year ago.

- According to the Federal Reserve, approximately 39% of Americans do not have enough savings to cover a $400 emergency expense.

- The average return on investment for the S&P 500 over the past 90 years is about 10% per annum.

External Links

How To

How To File Your Taxes Accurately

Filing your taxes accurately is essential to avoid penalties and ensure compliance. Start by gathering all necessary documents, including W-2s, 1099s, and any receipts for deductible expenses. Choose the appropriate filing method, whether using tax software, hiring a tax professional, or filing manually. Familiarize yourself with the tax deductions and credits available to maximize your refund or minimize your liability. Double-check your calculations and ensure all information is accurate before submission. If you are unsure about specific items, consider consulting IRS guidelines or a tax professional for clarification. Lastly, keep copies of your tax returns and supporting documents for future reference.

Did you miss our previous article...

https://hellofaread.com/money/uk-youth-prioritise-travel-wellness-over-traditional-savings-goals

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions