Economic Growth Forecast Reduced Sharply

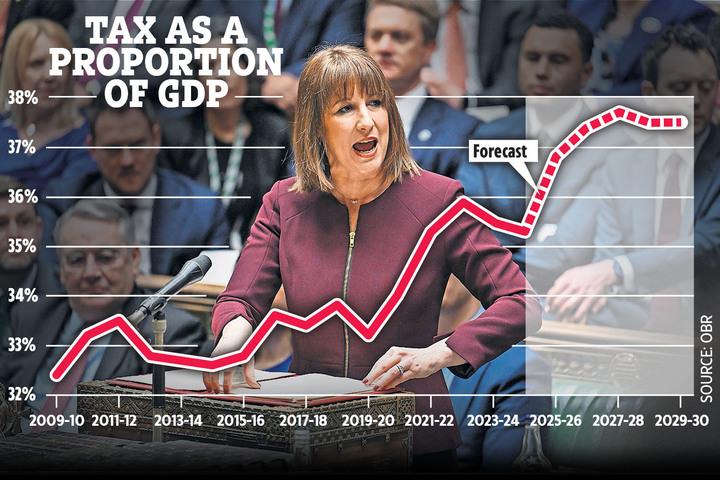

Rachel Reeves, the current Chancellor, is facing heightened scrutiny after the latest Spring Statement revealed a significant downgrade in the UK’s economic outlook. The Office for Budget Responsibility (OBR) has revised the GDP growth forecast for this year to a mere one per cent, effectively wiping out the government’s previously held £9.9 billion financial buffer. Additionally, the OBR warned of a potential uptick in inflation, adding further strain to the economic landscape.

Potential for Additional Tax and Spending Adjustments

In response to the bleak growth projections, Reeves has not dismissed the possibility of introducing further tax increases or implementing additional spending cuts in the upcoming autumn budget. Despite assurances to Times Radio that such measures are not inevitable, the Chancellor has remained cautious, indicating that the economic situation may necessitate tougher fiscal decisions to adhere to established financial guidelines.

Focus on Driving Economic Growth Through Reforms

Reeves remains committed to stimulating economic expansion through a series of reforms aimed at planning, pensions, and regulation. She believes that by fostering a more dynamic economy, the government can simultaneously enhance public services without escalating the tax burden. “If we go further and faster on delivering economic growth with our planning reforms, with our pensions reforms, with our regulatory reforms, we can both grow the economy and have more money for our public services,” Reeves stated.

Key Announcements from the Spring Statement

The Spring Statement included several notable measures:

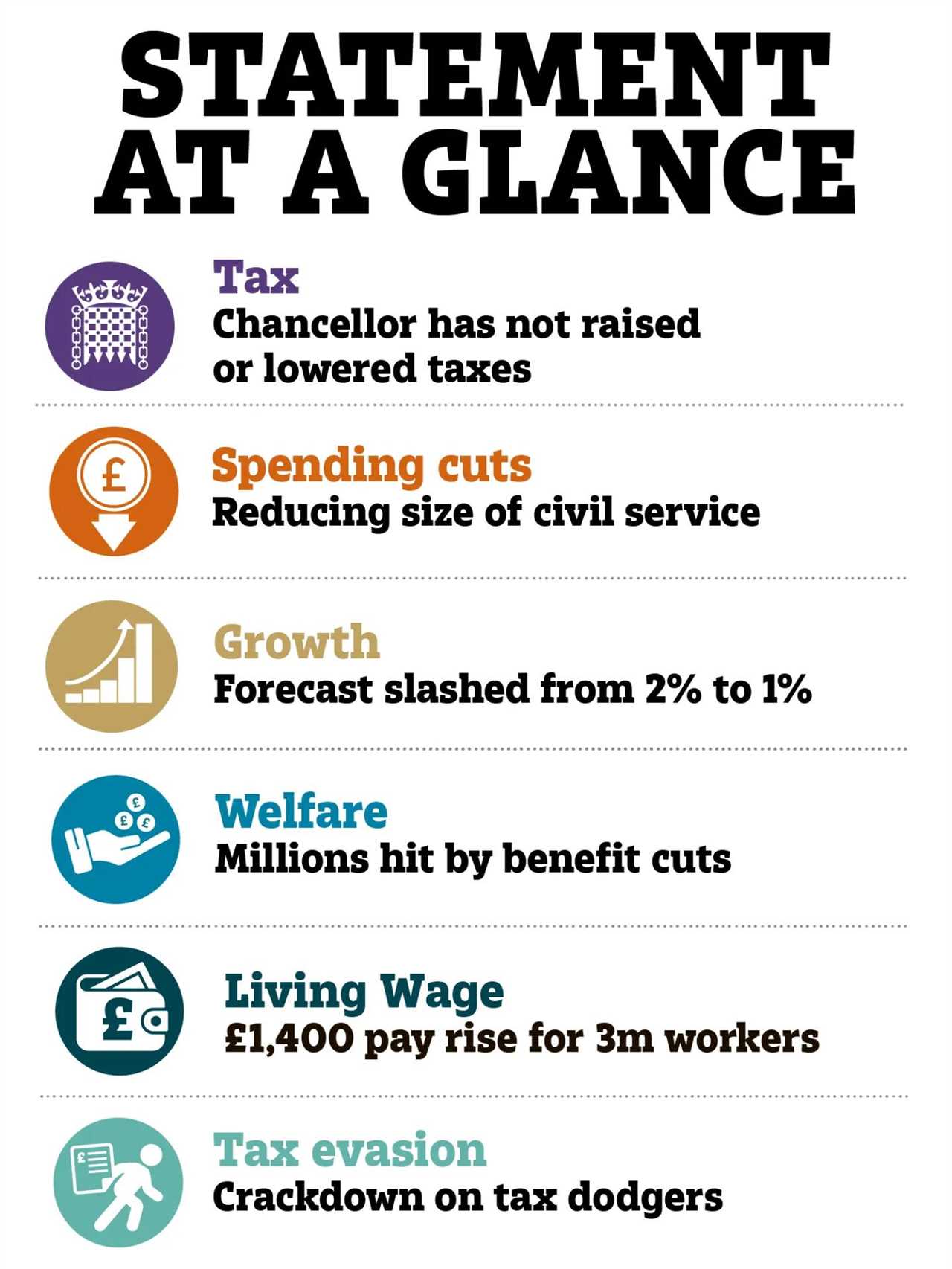

- No New Tax Increases: Reeves pledged to combat tax avoidance and aimed to generate an additional £1 billion without introducing new taxes.

- Housing and Construction Boost: New housing policies are expected to contribute an extra 0.6 per cent to GDP over the next decade, with housebuilding projected to reach a 40-year high of 1.3 million homes within five years.

- Increased Defence Spending: An additional £2.2 billion will support the 2.5 per cent of GDP defence target, alongside a £400 million Defence Innovation Fund to support advancements in technology for the military.

- Welfare and Civil Service Reforms: Targeted employment support and welfare restructuring aim to reduce benefit spending, while civil service cuts through voluntary exit schemes and the introduction of AI tools are expected to save £3.5 billion by 2029-30.

Welfare Cuts Draw Criticism Over Poverty Risks

Reeves’ decision to reduce welfare spending by £3.4 billion has sparked backlash from Labour MPs. The government’s own impact assessment warns that these cuts could push up to 250,000 individuals into poverty, raising concerns about the social implications of the proposed measures.

Optimistic Signs in Housebuilding and Defence

Despite the overall negative economic forecast, there are areas of progress. Housebuilding is set to reach unprecedented levels, and planning reforms are projected to provide a modest but steady increase in real GDP. Additionally, increased funding for defence and innovative technologies is seen as a positive step towards enhancing national security.

Opposition Labels Reeves’ Strategy Risky

Shadow Chancellor Mel Stride has sharply criticized Reeves, accusing her of taking reckless fiscal actions that jeopardize the nation’s financial stability. Stride described the Chancellor as a “gambler” who has “destroyed” livelihoods and harmed businesses through her economic policies. He argued that the current predicament is a direct result of Reeves’ choices, pointing to declining business confidence and failing economic measures.

Future Outlook and Uncertainties

The OBR’s forecast remains bleak, with predictions of the budget deficit staying high at 4.8 per cent of GDP in 2024-25 before gradually decreasing to 2.1 per cent by 2029-30. However, these projections exclude potential negative impacts from new regulations affecting business flexibility and labor markets. The Employment Rights Bill, still under parliamentary review, poses additional uncertainties, as its detailed implications on employment and productivity have yet to be fully assessed.

Reeves’ Commitment to a Leaner Government

In her efforts to address the economic challenges, Reeves has announced plans to streamline government operations, targeting £6 billion in cuts across various departments. She emphasized the need for a more efficient and responsive state, aiming to redirect resources to frontline services while reducing bureaucratic overhead.

As the UK navigates these turbulent economic times, Rachel Reeves’ strategies and decisions will be closely watched, with significant repercussions expected for both the public and the broader economy.

Frequently Asked Questions

What is a budget deficit?

A budget deficit occurs when a government's expenditures exceed its revenues over a specific period, usually a fiscal year. This can lead to increased borrowing and national debt if not addressed through spending cuts or revenue increases.

What is the definition of money?

Money is a medium of exchange that facilitates transactions for goods and services. It serves as a unit of account, a store of value, and a standard of deferred payment, allowing individuals to compare the value of diverse products and services.

What is the importance of financial literacy?

Financial literacy is essential for making informed decisions about budgeting, saving, investing, and managing debt. It empowers individuals to understand financial concepts, evaluate risks, and navigate complex financial products, leading to better financial stability and long-term wealth building.

What is the role of central banks in the economy?

Central banks manage a nation's currency, money supply, and interest rates. They implement monetary policy to control inflation, stabilize the currency, and foster economic growth. They also serve as lenders of last resort to the banking system during financial crises.

What are the different types of money?

The main types of money include commodity money, which is based on physical goods like gold or silver; fiat money, which is government-issued currency not backed by a physical commodity; and digital currency, which exists electronically and is often decentralized, such as cryptocurrencies.

What are the benefits of having an emergency fund?

An emergency fund provides financial security by offering a safety net for unexpected expenses, such as medical emergencies or job loss. It helps prevent debt accumulation, reduces stress, and allows for better financial planning, ensuring that individuals can navigate unforeseen circumstances without significant hardship.

What is the difference between saving and investing?

Saving typically involves setting aside money in a secure account for short-term needs or emergencies, while investing involves using money to purchase assets like stocks or real estate with the expectation of generating a return over the long term. Investing carries higher risks but offers the potential for greater rewards.

Statistics

- According to the Bureau of Labor Statistics, the average American spends about $1,500 per year on coffee.

- Research by the National Bureau of Economic Research found that individuals who receive financial education are 25% more likely to save than those who do not.

- According to the World Bank, around 1.7 billion adults worldwide remain unbanked, lacking access to basic financial services.

- As of 2021, the median household income in the U.S. was approximately $67,521, according to the U.S. Census Bureau.

- According to a survey by the Financial Industry Regulatory Authority (FINRA), about 66% of Americans could not correctly answer four basic financial literacy questions.

- According to the Federal Reserve, approximately 39% of Americans do not have enough savings to cover a $400 emergency expense.

- A report by Bankrate indicated that only 29% of Americans have a written financial plan.

- The average return on investment for the S&P 500 over the past 90 years is about 10% per annum.

External Links

How To

How To Manage Debt Wisely

Managing debt wisely involves understanding your financial obligations and creating a structured repayment plan. Begin by listing all debts from smallest to largest, including interest rates and minimum payments. Consider using the snowball method, where you focus on paying off the smallest debts first, which can provide motivation. Alternatively, the avalanche method prioritizes debts with the highest interest rates to minimize overall interest paid. Make consistent payments above the minimum on your chosen debts while maintaining regular payments on others. Additionally, consider consolidating high-interest debts into a single loan with a lower rate, which can simplify your payments and reduce interest costs.

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions