TEMPERATURES are dropping just as average energy bills rise to a chilling £2,500 from this month.

Homes will get a £400 energy bill rebate, but with so many other costs soaring, it’s important to cut back where possible.

Average energy bills rise to a chilling £2,500 from this month

The Government’s Energy Price Guarantee only caps how much you pay for the units you actually use, so the less you consume the better.

Harriet Cooke looks at the gadgets and gizmos you can use to save energy – and your bank balance.

Electric blankets

A SINGLE blanket on its highest setting costs around 1.4p an hour to run. It’s 3p for a king size.

In contrast, firing up a 24kw boiler to warm just one room in the house costs an average £2.47 for an hour, according to Energy Helpline.

Using an electric blanket could save as much as £290 in winter

This saving would add up to £290 if you used a king size blanket instead of heating for an hour every night from November to February.

COST: Single, £25, double, £30, and king, £35, from B&M

SAVING: £290 in winter

Radiator reflectors

PUTTING reflectors or tin foil behind your radiators stops the heat disappearing into external walls.

There’s no need to bother if the walls are internal.

Putting reflectors or tin foil behind your radiators stops the heat disappearing into external walls

Putting reflectors or tin foil behind your radiators stops the heat disappearing into external walls

Ben Gallizzi, energy expert at Uswitch.com, said: “Radiator reflectors cost as little as £14 for a roll, but some products claim to reduce heat loss by up to half.

“With the average household spending more than £900 a year on heating, even a five per cent efficiency saving would cut your gas bill by £45.”

COST: £14.08 from B&Q

SAVING: £45 a year

Dehumidifiers

USING a tumble dryer twice a week would cost £2.04 or £106.08 a year, Uswitch calculates.

When the heating is on, you might put clothes on radiators or racks instead, but this can cause condensation and mould.

A dehumidifier costs around 13p to run for two hours, so around 25p for four hours a week – £13 for the year

A dehumidifier costs around 13p to run for two hours, so around 25p for four hours a week – £13 for the year

You won’t want to waste heat by opening your windows, so try a dehumidifier instead.

These cost around 13p to run for two hours, so around 25p for four hours a week – £13 for the year.

COST: £140 from Wickes

SAVING: £93 a year

Heated airers

FOR a speedier way to dry your laundry, try a heated airer – which cost around 10p for every hour of use.

Uswitch reckons they save £84.86 a year versus the cost of a tumble dryer.

For a speedier way to dry your laundry, try a heated airer – which cost around 10p for every hour of use

For a speedier way to dry your laundry, try a heated airer – which cost around 10p for every hour of use

COST: £39.99, from Aldi (back in stores today but likely to sell out fast)

SAVING: £84.86 in a year

Tumble dryer balls

IF you do use your tumble dryer, placing wool balls in with your washing can reduce drying time by a quarter.

They help retain heat and prevent laundry from clumping.

If you do use your tumble dryer, placing wool balls in with your washing can reduce drying time by a quarter

If you do use your tumble dryer, placing wool balls in with your washing can reduce drying time by a quarter

One tumble dryer cycle typically costs £1.02, says Uswitch.

So using the dryer balls twice a week for a year would save around £26.52.

COST: £12.99 for a pack of six from Amazon

SAVING: £26.52 a year

LED lights

LED bulbs use up to 80 per cent less energy than halogen bulbs and cost as little as £5 for a two-pack from Tesco.

The Energy Saving Trust says households can save up to £15 per bulb a year by switching from incandescent, or up to £6 switching from halogen.

LED bulbs use up to 80 per cent less energy than halogen bulbs

LED bulbs use up to 80 per cent less energy than halogen bulbs

So swapping ten bulbs might cost £25, but the savings can be as much as £150 on bills.

COST: £25 for ten

SAVING: £150 a year

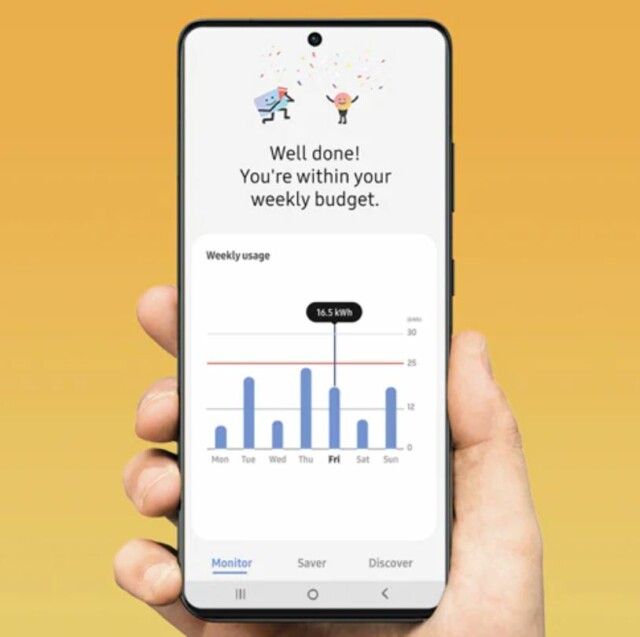

Do the maths

IT’S time to track your energy usage in detail.

Samsung’s SmartThings Energy app shows what individual appliances cost you each day and sends alerts if you reach your daily budget.

Samsung’s SmartThings Energy app shows what individual appliances cost you each day

Samsung’s SmartThings Energy app shows what individual appliances cost you each day

It claims some users have saved £200 on their bills compared with the previous year.

On the Currys website you can see how much products will save in energy costs compared with the least efficient model.

COST: Free

SAVINGS: £200

‘Costs soar when work from home’

TEACHER Michelle Pitt, 35, and husband Charlie, 37, a graphic designer, were surprised to discover how much energy they used in their five-bedroom home in Sutton Coldfield, West Mids, where they live with son Luca, seven.

The family have a smart meter but installed Samsung’s SmartThings Energy app – which works with any smart meter – after their bills trebled from £150 to £450 a month.

Michelle Pitt, pictured with husband Charlie said: ‘It’s easy to track the cost of the energy we’re using hour by hour and see which appliances are most expensive’

Michelle Pitt, pictured with husband Charlie said: ‘It’s easy to track the cost of the energy we’re using hour by hour and see which appliances are most expensive’

Michelle said: “It’s easy to track the cost of the energy we’re using hour by hour and see which appliances are most expensive.

“We were shocked to discover that when my husband works from home, it costs us about £5 or £6 a day because he uses several computers at once.

“Whereas if he goes out to work it’s only about £1.80. So he’s going to go into the office more.”

“I also noticed a big surge in use from 6pm to 7pm, where we spent about 70p in an hour because we had three TVs on in different rooms.

“If we’re not in, we spend about 8p an hour, which I think must be due to the fridge and devices on standby.

“You can’t see how much energy each appliance is using if it’s not a smart model, but because it shows your energy use hour by hour, you can roughly work it out.”

Shell’s bills boost

THOUSANDS of Shell Energy customers will get an extra £150 to help them pay their bills this winter.

The supplier is boosting the standard £150 warm home discount payment for all 157,000 customers who get the help.

If you qualify, you’ll receive double the usual amount, meaning you will get £300 in total.

You get the bill discount if you were receiving certain low-income benefits and joined Shell Energy on or before August 21 this year.

Unlike previous years, the support will be paid automatically and you don’t have to apply.

We’ve asked other suppliers if they will be boosting payments and will update readers when we hear.

To get the standard discount you’ll need to be on one or more of the following benefits: Income support, income-based jobseeker’s allowance, income-related employment and support allowance, housing benefit, Universal Credit, child tax credit, working tax credits, pension credit.

If you qualify, you should get a letter from the Department for Work and Pensions in October confirming this.

Payments will likely begin in December, but it varies by supplier.

Bank a bonus £200

CUSTOMERS are being offered up to £200 to switch current accounts – just in time for Christmas.

Nationwide building society is making the £200 offer while TSB is paying £180 to entice customers to move to them.

Customers are being offered up to £200 to switch current accounts – just in time for Christmas

Customers are being offered up to £200 to switch current accounts – just in time for Christmas

To get the £200, you need to switch from a non-Nationwide current account to its FlexDirect, FlexPlus or FlexAccount and set up two active direct debits.

The cash will then be paid within ten days.

FlexDirect customers who pay in £1,000 a month will also get 5 per cent interest for a year on balances up to £1,500.

Some may also qualify for a 12-month interest-free overdraft.

TSB is offering £180 to switch to its Spend & Save account, paid in two stages.

You’ll get £125 after setting up two or more direct debits.

This should be paid before December 16, depending on when you open the account.

You’ll get the remaining £55 after using your debit card five times and paying £500 into the account.

The remaining bonus should be paid by June 30 if these conditions are met

You need to switch through Money SuperMarket or MoneySavingExpert to get the payout.