THE state pension age is rising to 66 today, meaning hundreds of thousands of Brits will have to wait longer to start claiming.

Thankfully, there are ways to boost your retirement pot – we explain how.

The state pension age is increasing from 65 to 66

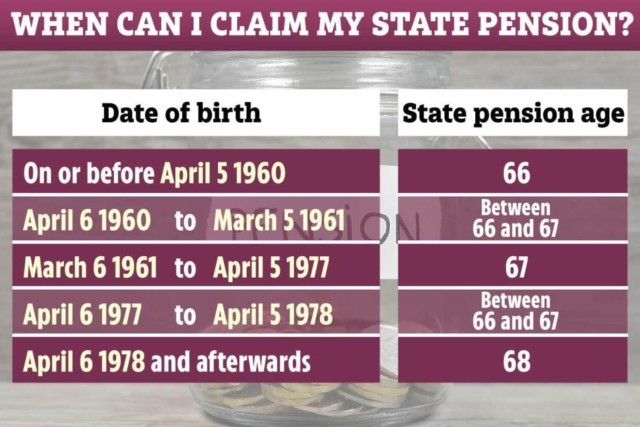

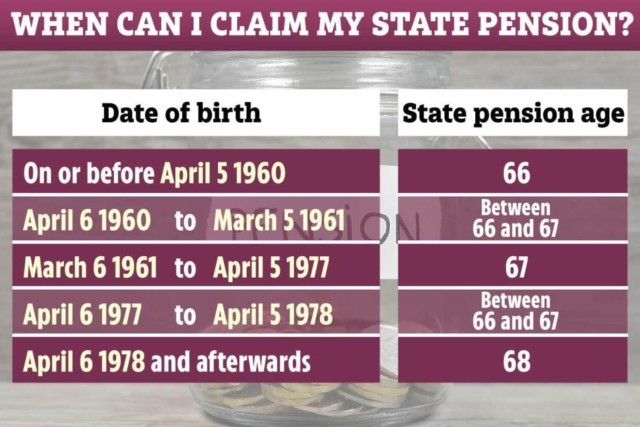

The increase to the state pension age – which goes up from 65 to 66 – applies to both men and women born after October 5, 1954.

It means anyone born after this date will have to work at least another year before they can access their state-paid retirement fund.

The change was first announced in 2010 by then chancellor George Osborne, with further increases expected over the next few years.

The state pension age is set to rise again to 67 in 2028, and to 68 from 2044 – although there are plans to bring this forward to 2037.

The last rise was in November 2018, when the age for women to claim the state pension was increased from 60 to 65, in line with the same age for men.

For retirees, the new state pension is currently worth £175.20 per week, while the old basic state pension is £134.25 per week.

If you’re a man born on or after April 6, 1951, or a woman born on or after April 6, 1953, you’ll be able to claim the new state pension.

Anyone who reached the state pension age before April 6, 2016 will be getting the old basic state pension.

If you’re worried about your retirement pot, there are ways to boost your finances for your golden years.

How to boost your pension

1. Don’t opt-out of your workplace pension: All employers must offer a workplace pension scheme.

This is where a percentage of your salary goes into a retirement pot, with your employer also contributing towards this fund.

From April 2019, a minimum of 8% must be paid into the pension, with you contributing 5% and your employer paying at least 3%.

Workers who are eligible are automatically enrolled, so staying part of your workplace pension scheme if you can is one way of boosting your retirement fund.

You can choose to opt out, for example, if you’re struggling financially.

You will be automatically enrolled into your work’s pension scheme if you meet the following criteria:

- You aren’t already in a qualifying workplace scheme.

- You are aged at least 22.

- You are below state pension age.

- You earn more than £10,000 a year in 2019/20.

- You work in the UK.

2. Track down lost pensions: If you’ve moved jobs a lot, you could have several pension pots with various employers – this means you may be sitting on extra cash that you’d forgotten about.

We spoke to airport worker Ernie Davenport, 54, who revealed how he found £21,000 in lost pensions. Profile Pensions estimates Brits have lost 1.6million pension pots, containing a total of £37billion.

To help you track them down, the government has a free pension tracing service online.

It should have details of all the pensions listed in your name in the UK, but you’ll need to provide accurate information about yourself to get results.

You can also call up the Pension Tracing Service by phone on 0800 731 0193.

3. Plan ahead with online financial tools: Aviva and Royal London have online tools that give you an idea of what your retirement income will be.

Their calculations are based on how much you’re saving, when you were born, and what age you want to retire at.

By knowing how much money you’re expected to retire with, you’ll have a better idea about whether you should be saving more.

4. Find out if your workplace offers advice: Many employers offer financial advice to help you plan for your retirement.

The help available will vary between companies, but your best bet is to speak to your HR service to see what it can offer.

Most of the time, you won’t need to pay for advice through your work.

5. Apply for pension credit: Pension credit is a means-tested benefit that helps those on lower incomes.

There are two parts to the benefit and pensioners can be eligible for one or both parts:

- Guarantee credit – tops up your weekly income to a guaranteed minimum level. This is £167.25 a week if you’re single and £255.25 a week for married couples.

- Savings credit – provides extra money if you’ve saved money towards retirement. You can get an extra £13.75 a week for a single person or £15.35 a week for a married couple. Savings credit is only available to those on the old state pension though.

To apply, call the pension credit claim line on 0800 99 1234.

6. Delay your pension: The longer you wait to retire, the more time you have to save up – although you will be working longer.

You’ll want to check with your provider first, however, to see whether there will be any charges for changing your estimated retirement date.

This applies to private and workplace pensions.

For a state pension, Money Advice Service says you’ll increase your pot by 1% for every nine weeks you defer. This works out as just under 5.8% for every full year.

7. Check if you’re being underpaid – women only: A new tool was launched this year by former pensions minister Steve Webb after he found examples of women being underpaid their state pension.

It’s estimated tens of thousands of women could be affected.

How much you get from the state pension depends on how many years worth of national insurance contributions (NICs) you’ve built up through working.

But under the basic state pension, there is a clause that allows married women to top-up their pensions if they’re not receiving a certain amount.

The full basic state pension is £134.25 a week, but if you’re a woman who is married or in a civil partnership and you currently get less than £80.45 a week in state pension payment, you might be able to top it up to this £80.45 amount.

You can get the top up if both you and your partner have reached state pension age and either:

- your spouse or civil partner reached state pension age before April 6, 2016 and qualifies for some basic state pension, even if they have not claimed it

- your spouse or civil partner reached state pension age on or after April 6, 2016 and has at least one qualifying year of national insurance contributions or credits from before April 6, 2016, even if they do not qualify for any new state pension or they have not claimed it

If, however, your spouse or civil partner was born before April 6, 1950, you can only get the top up if you’re a woman who is married to either:

- a man

- a woman who legally changed their gender from male to female during your marriage

HOAR has revealed how switching from your workplace pension could cost you £247,000.

Even once you retire it’s important to shop around if you take a flexible income from your pension as Which? said those who do could save £20,600 on fees.

Plus, here’s how to avoid a pension crisis and make sure you’ve saved enough for retirement.