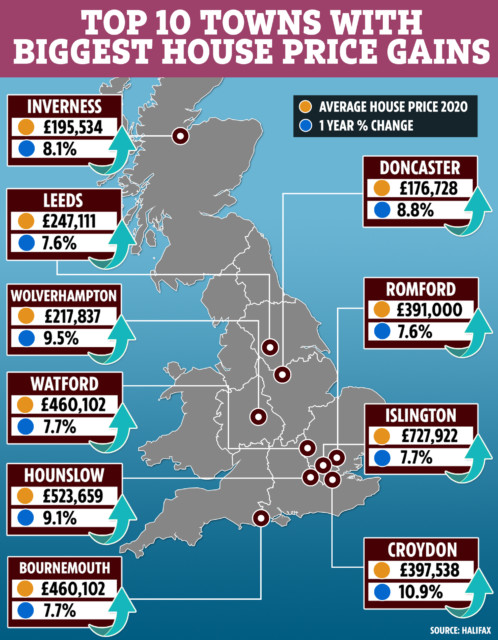

THE towns where house prices increased the most in 2020 have been revealed following a year of ups and downs due to coronavirus.

The London district of Islington topped the table after average property prices jumped a whopping £85,918 (13.4%) from £642,004 to £727,922 in just 12 months.

Here are the biggest house price increases in the UKOutside London, the biggest mover was Leeds, which had the country’s second-fastest rise of 11.3% to an average of £247,116, according to research by Halifax.

Next up, London’s Croydon came in third place after house prices grew by 10.9% to £397,538, having only risen by 1% last year.

While Wolverhampton came fourth, with house prices up 9.5% to £217,837.

The research from Halifax also found that, at the other end of the table, the average house price in Paisley, west of Glasgow, fell by 1.7% to £138,036.

It means the town fared the worst in terms of house prices in 2020, followed second by Hackney in London, where prices fell 1.5% to £636,002.

Overall, Greater London took nine of the top 20 places for house price rises, which is good news for homeowners but bad for first-time buyers.

Average house prices across the UK rose by £29,307 (10.6%), from £275,291 to £304,598.

Halifax based its data on areas with more than 200 property transactions, covering 12-month rolling data to October in both 2019 and 2020.

It comes as the housing market has swung back from the first coronavirus lockdown, which effectively saw it shut for a seven-week period this spring.

House prices have since hit record highs following a temporary stamp duty holiday on properties worth up to £500,000, which has boosted demand.

The tax break is positive for sellers who can seize the opportunity to cash in, but buyers risk paying over the odds if the house price boom doesn’t last.