HARD-UP Brits are being warned about “misleading” ads from debt firms which could leave them worse off.

Today the Advertising Standards Authority has banned “misleading” ads for two debt companies offering the individual voluntary arrangements (IVAs).

Both wrongly gave the impression they were officially sanctioned to offer the plans – and one even suggested it was linked to respected debt charity StepChange.

Instead, Fidelitas Group and Step Debt Support are commercial operations that make money by helping arrange IVAs, a formal type of personal insolvency.

Such adverts were slammed by debt charities who say IVAs are “high risk” and often may not be the most suitable option.

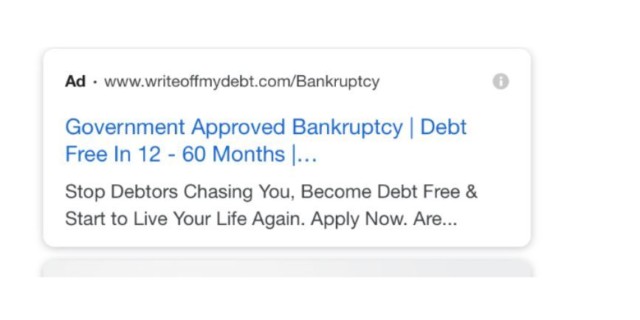

Fidelitas Group had its adverts banned by watchdogs for a string of false claims, including suggesting it was endorsed by the Government and also wrongly saying they were qualified to provide debt counselling.

Another outfit National Service Direct, trading as Step Debt Support, also broke rules by exaggerating the speed debts could be cut.

It was also wrapped for misleadingly suggesting it was linked to respected debt charity Step Change and the Government.

The ASA said both firms also suggested the services were free, when they weren’t.

Both had internet search ads banned over fears struggling families would use their services to cut debts – but would not get the help they expected.

Richard Lane, from StepChange Debt Charity, said: “People who need help with their debts need advice, not a hard sell.

“It’s clear that there’s a need for better protection to prevent people being hoodwinked into thinking they are dealing with a debt advice charity, when in fact they are simply being lured to provide their personal details to lead generators working on behalf of commercial IVA factories.

“The ASA has confirmed what we already knew: there is a lot of misleading advertising out there, including from outfits impersonating legitimate debt advice organisations.”

StepChange said the fee incentives to firms arranging IVAs mean they often give the wrong advice.

The charity said: “While IVAs can be a very good solution for some people, they can be high risk and expensive if they fail – so it is imperative that they are not mis-sold.”