New "Jobs Tax" Hits Working Families Hard

From today, millions of UK households will experience a significant increase in their monthly expenses, with an estimated jump of £4,500 looming on the horizon. A substantial portion of this rise is attributed to the introduction of the new "Jobs Tax," which is projected to cost working families approximately £3,536 over the current Parliament period. This tax hike arises as companies adjust to the National Insurance increase by reducing wages, directly impacting take-home pay for many employees.

Essential Bills Also Set to Climb

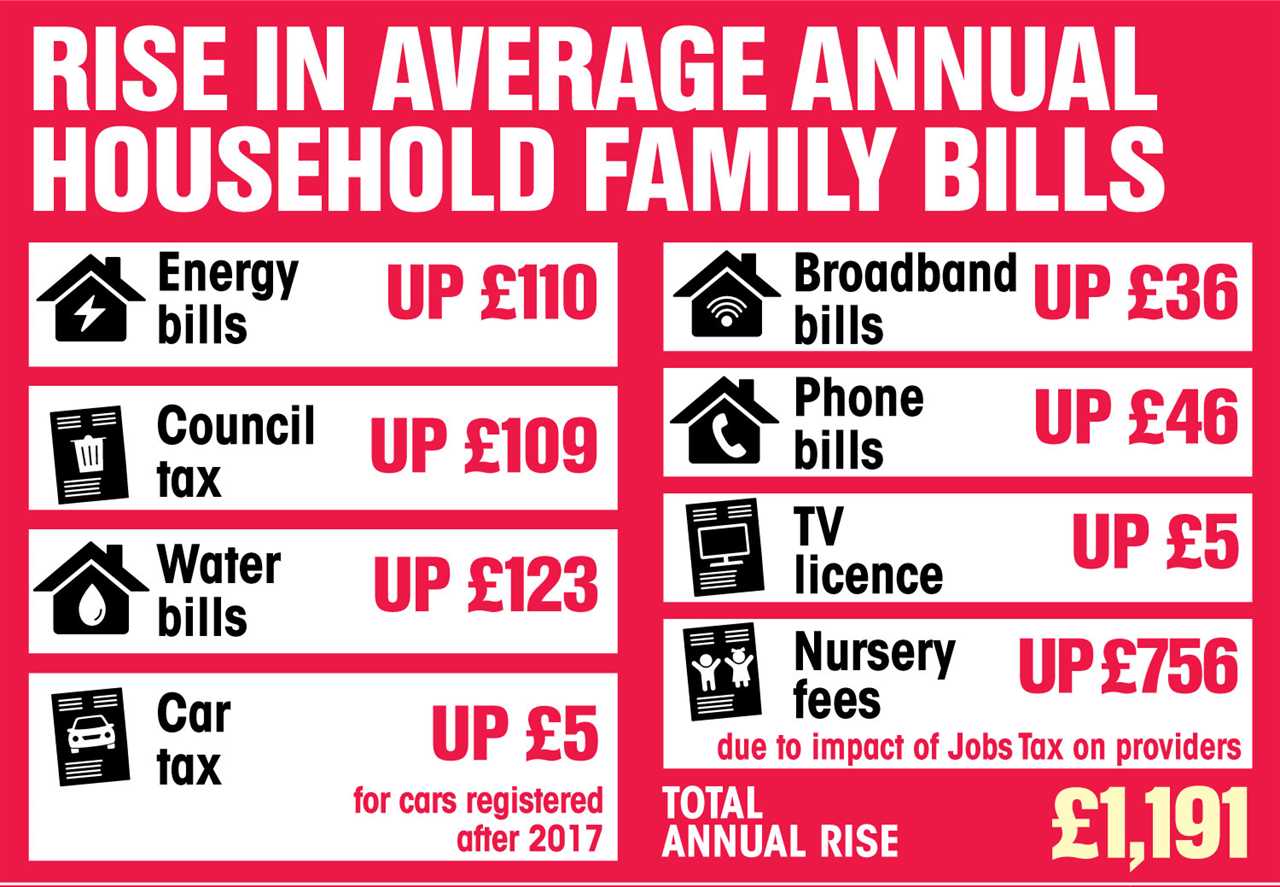

In addition to the "Jobs Tax," households will see their regular bills increase, adding another £1,191 to expenses this financial year. Key areas affected include energy, water, broadband, TV licence, car, and council tax. These combined rises come at a time when many families are already struggling to keep up with everyday costs, further straining household budgets.

Families Under Pressure

Recent data highlights that the most vulnerable ten percent of households are nearing their financial limits. These families are currently allocating 41 percent of their earnings to bills, excluding housing costs. With the new tax and increased bills, the financial pressure on these households is expected to intensify, pushing many to the brink of financial instability.

Political Tensions Escalate

Conservative leader Kemi Badenoch has criticized Chancellor Rachel Reeves for her handling of the economy, particularly the National Insurance rises. Badenoch accused Reeves of "gambling" with the nation's finances, arguing that the increased costs will force companies to cut wages and reduce job opportunities. Tory party research indicates that much of the £25 billion government bill will be offset by lower wages and potential job cuts, exacerbating the cost of living crisis.

Impact on the Hospitality Sector

The rise in costs is not limited to households. Kate Nicholls, chief of UKHospitality, revealed that the pub and restaurant sector is facing an additional £3.4 billion in annual expenses. This includes £1.9 billion in wage costs, £1 billion in National Insurance, and £500 million in business rates. These added costs are expected to lead to significant job cuts, with seven out of ten businesses considering reducing their workforce to cope with the financial strain.

Business Leaders Call for Relief

Lawson Mountstevens, head of Star Pubs & Bars, emphasized the need for the government to mitigate the financial burden on businesses. He pointed out that profit margins in the hospitality industry are already minimal and that further costs could have devastating effects. Mountstevens urged the government to honor its commitment to reforming business rates, which could provide much-needed relief to struggling businesses.

Labour Pushes Back Against Conservative Policies

A Labour spokesperson responded to the Conservative critique by accusing the Tories of undermining public services over the past 14 years. They vowed to reverse what they described as the Conservative Party's "vandalising" of essential services, particularly the NHS. Labour aims to increase investment in healthcare and other public sectors, positioning themselves as the party committed to supporting families and public services amidst rising living costs.

Looking Ahead: What This Means for Families

The combined effects of the new "Jobs Tax" and rising household bills present a challenging landscape for UK families. With essential services and daily expenses becoming more expensive, many households will need to tighten their budgets and make difficult financial decisions. The political debate surrounding these changes underscores the broader struggle to balance economic policy with the well-being of citizens.

As the cost of living continues to climb, the pressure on both individuals and businesses will likely intensify. How the government navigates these economic challenges will be crucial in determining the financial stability and quality of life for millions of UK families in the months ahead.

Frequently Asked Questions

What are credit scores and why are they important?

Credit scores are numerical representations of an individual's creditworthiness, calculated based on credit history, payment behavior, and debt levels. They are important because they impact the ability to obtain loans, credit cards, and favorable interest rates, affecting overall financial health.

What are the benefits of having an emergency fund?

An emergency fund provides financial security by offering a safety net for unexpected expenses, such as medical emergencies or job loss. It helps prevent debt accumulation, reduces stress, and allows for better financial planning, ensuring that individuals can navigate unforeseen circumstances without significant hardship.

What is the definition of money?

Money is a medium of exchange that facilitates transactions for goods and services. It serves as a unit of account, a store of value, and a standard of deferred payment, allowing individuals to compare the value of diverse products and services.

How does inflation affect the value of money?

Inflation refers to the general rise in prices over time, which erodes the purchasing power of money. As inflation increases, each unit of currency buys fewer goods and services, meaning that the value of money decreases in terms of what it can purchase.

What is the role of central banks in the economy?

Central banks manage a nation's currency, money supply, and interest rates. They implement monetary policy to control inflation, stabilize the currency, and foster economic growth. They also serve as lenders of last resort to the banking system during financial crises.

What is the difference between saving and investing?

Saving typically involves setting aside money in a secure account for short-term needs or emergencies, while investing involves using money to purchase assets like stocks or real estate with the expectation of generating a return over the long term. Investing carries higher risks but offers the potential for greater rewards.

How can I improve my credit score?

To improve your credit score, make timely payments on all debts, reduce credit card balances, avoid opening unnecessary credit accounts, and regularly check your credit report for errors, disputing any inaccuracies. Maintaining a mix of credit types and keeping old accounts open can also be beneficial.

Statistics

- According to a Gallup poll, 56% of Americans report that their financial situation is better than it was a year ago.

- According to the Bureau of Labor Statistics, the average American spends about $1,500 per year on coffee.

- In 2020, the average retirement savings for Americans aged 60 to 69 was approximately $195,000, according to Fidelity.

- A report by Bankrate indicated that only 29% of Americans have a written financial plan.

- The average cost of raising a child in the U.S. is estimated to be around $233,610, according to the U.S. Department of Agriculture.

- As of 2021, the average student loan debt for recent graduates was approximately $30,000, according to the Federal Reserve.

- Research by the National Bureau of Economic Research found that individuals who receive financial education are 25% more likely to save than those who do not.

- According to the Federal Reserve, approximately 39% of Americans do not have enough savings to cover a $400 emergency expense.

External Links

How To

How To Start Investing for Beginners

Starting to invest can be daunting, but it is a crucial step towards building wealth. Begin by setting clear financial goals, such as saving for retirement or a major purchase. Educate yourself on different investment options, including stocks, bonds, mutual funds, and ETFs. Consider starting with a brokerage account that offers user-friendly platforms and educational resources. Diversify your investments to reduce risk, and consider low-cost index funds or robo-advisors if you prefer a hands-off approach. Make regular contributions, and resist the temptation to react to market fluctuations. Over time, compound interest will help your investments grow significantly.

Did you miss our previous article...

https://hellofaread.com/money/transform-your-home-this-spring-without-breaking-the-bank

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions