Discover Tesco's Hidden Rewards on Your Receipts

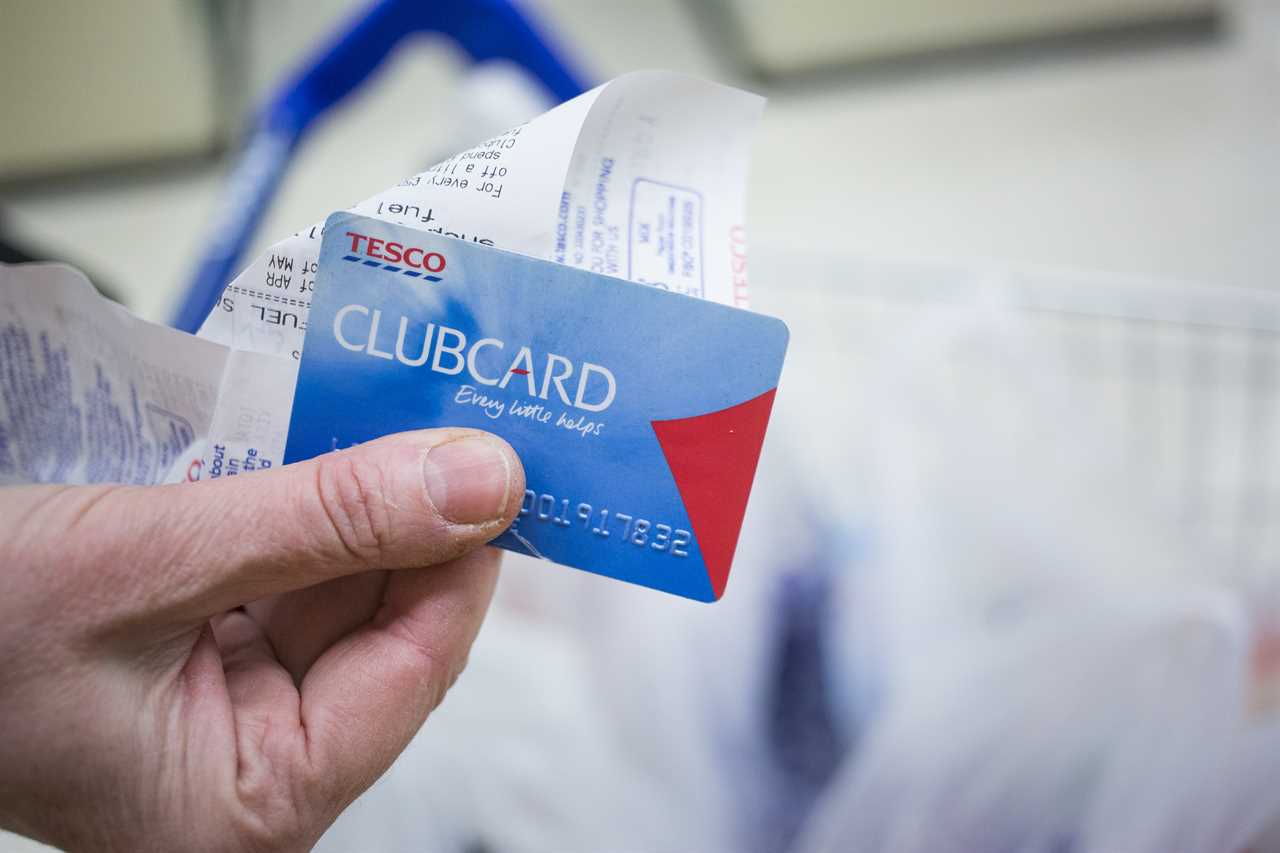

Many Tesco shoppers are only now realizing the potential savings hidden within their purchase receipts. The supermarket giant has been quietly offering free products and significant discounts to its customers, especially through its Clubcard rewards program.

Maximise Your Clubcard Benefits

Being a Clubcard holder unlocks a world of personalised coupons tailored to your shopping habits. These coupons can be found in the Tesco app or on your Clubcard statement, providing opportunities to save on future purchases. Whether it's discounts on your favourite products or exclusive freebies, the Clubcard ensures that loyal customers receive added value from their shopping experience.

Real Stories of Shoppers Snagging Freebies

In the past, diligent Tesco customers have discovered surprising freebies by simply checking their receipts. For instance, some have received free packs of nappies worth up to £10, just by being attentive during checkout. One happy customer shared, "It pays to always select receipt at Tesco, you never know what free offer would come your way." To claim these freebies, shoppers need to present their receipt to a store employee, so it's essential to keep receipts safe until the offer period ends.

Essential Tips for Claiming Your Free Offers

Always review your receipt promptly to ensure you don't miss out on any available offers. It's important to note the validity period of each offer and act within the specified timeframe. Typically, these offers are exclusive to Clubcard members, making it worthwhile to sign up and take advantage of the rewards system.

Beyond Tesco: Other Supermarkets Joining the Freebie Trend

Tesco isn't the only supermarket offering personalised freebies to loyal customers. Marks & Spencer (M&S) has also entered the fray with enticing offers for its Sparks members. For example, M&S shoppers have been offered free packets of their popular Outrageously Chocolatey Milk Chocolate Biscuits, a treat usually priced at £6. To qualify, customers need to be part of the Sparks loyalty program and enrolled in its parenting club, ensuring that the offers are relevant and appealing.

Sainsbury's Adds to the Freebie Frenzy

Sainsbury's isn't left behind either. Nectar Card holders at Sainsbury's have had the chance to receive vouchers for free items like fabric softener. These vouchers are typically printed at the till along with the receipt, making it convenient for shoppers to redeem their rewards. Keeping an eye on these receipts can lead to unexpected savings and freebies during regular shopping trips.

How to Stay Ahead and Make the Most of These Offers

To ensure you don't miss out on these valuable offers, consider the following tips:

- Always select to receive a printed receipt when shopping.

- Regularly check your Clubcard app or statements for new coupons and offers.

- Act quickly on any freebies or discounts before their expiry date.

- Stay updated with your supermarket's loyalty programs and any new benefits they introduce.

Final Thoughts: Small Efforts Yield Big Savings

While the idea of receiving hidden freebies might seem serendipitous, it's often the result of consistent participation in loyalty programs like Tesco's Clubcard. By staying informed and proactive, shoppers can significantly reduce their grocery bills and enjoy complimentary products, making everyday shopping a more rewarding experience.

Join the Loyalty Programs Today

Whether you're a regular Tesco Clubcard member, an M&S Sparks enthusiast, or a Sainsbury's Nectar Card holder, these loyalty programs are designed to enhance your shopping experience. Signing up is free, and the benefits can add up quickly with each trip to the store. Don’t let hidden offers pass you by—embrace these programs and start reaping the rewards today.

Frequently Asked Questions

What is the difference between saving and investing?

Saving typically involves setting aside money in a secure account for short-term needs or emergencies, while investing involves using money to purchase assets like stocks or real estate with the expectation of generating a return over the long term. Investing carries higher risks but offers the potential for greater rewards.

What are the risks associated with investing in the stock market?

Investing in the stock market involves several risks, including market volatility, economic downturns, and company-specific factors that can lead to losses. Investors may also face liquidity risk, where they cannot sell an investment quickly without incurring a loss. Diversification and thorough research can help mitigate these risks.

What is the definition of money?

Money is a medium of exchange that facilitates transactions for goods and services. It serves as a unit of account, a store of value, and a standard of deferred payment, allowing individuals to compare the value of diverse products and services.

What is the importance of financial literacy?

Financial literacy is essential for making informed decisions about budgeting, saving, investing, and managing debt. It empowers individuals to understand financial concepts, evaluate risks, and navigate complex financial products, leading to better financial stability and long-term wealth building.

What are the benefits of having an emergency fund?

An emergency fund provides financial security by offering a safety net for unexpected expenses, such as medical emergencies or job loss. It helps prevent debt accumulation, reduces stress, and allows for better financial planning, ensuring that individuals can navigate unforeseen circumstances without significant hardship.

What are the main functions of money?

The primary functions of money are as a medium of exchange, facilitating trade; a unit of account, which provides a standard measure of value; a store of value, allowing individuals to save and transfer purchasing power over time; and a standard of deferred payment, enabling credit transactions.

How can I start saving for retirement?

To start saving for retirement, begin by establishing clear retirement goals and determining how much you need to save. Contribute to employer-sponsored retirement plans, such as a 401(k), and consider opening an Individual Retirement Account (IRA). Regular contributions and taking advantage of compounding interest can significantly boost your retirement savings over time.

Statistics

- As of 2021, the average student loan debt for recent graduates was approximately $30,000, according to the Federal Reserve.

- As of 2021, the median household income in the U.S. was approximately $67,521, according to the U.S. Census Bureau.

- A study by the National Endowment for Financial Education found that 60% of Americans do not have a budget.

- The average return on investment for the S&P 500 over the past 90 years is about 10% per annum.

- A survey by the American Psychological Association found that 72% of Americans reported feeling stressed about money at some point in the past month.

- According to the Federal Reserve, approximately 39% of Americans do not have enough savings to cover a $400 emergency expense.

- According to a Gallup poll, 56% of Americans report that their financial situation is better than it was a year ago.

- Research by the National Bureau of Economic Research found that individuals who receive financial education are 25% more likely to save than those who do not.

External Links

How To

How To Save for Retirement Effectively

Saving for retirement begins with setting clear goals regarding when you want to retire and how much money you will need. Start by contributing to employer-sponsored retirement plans like a 401(k), especially if your employer offers matching contributions. If self-employed or your employer does not provide a plan, consider opening an Individual Retirement Account (IRA). Aim to save at least 15% of your income annually, including employer contributions. Regularly review and adjust your contributions as your income changes. Diversify your investments within your retirement accounts to reduce risk and maximize potential returns over time.

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions