From next week, millions of households will face an increase in energy bills as the new price cap takes effect.

The price ceiling will rise by 6.4%, translating to an additional £111 annually for a typical dual fuel tariff paid through direct debit.

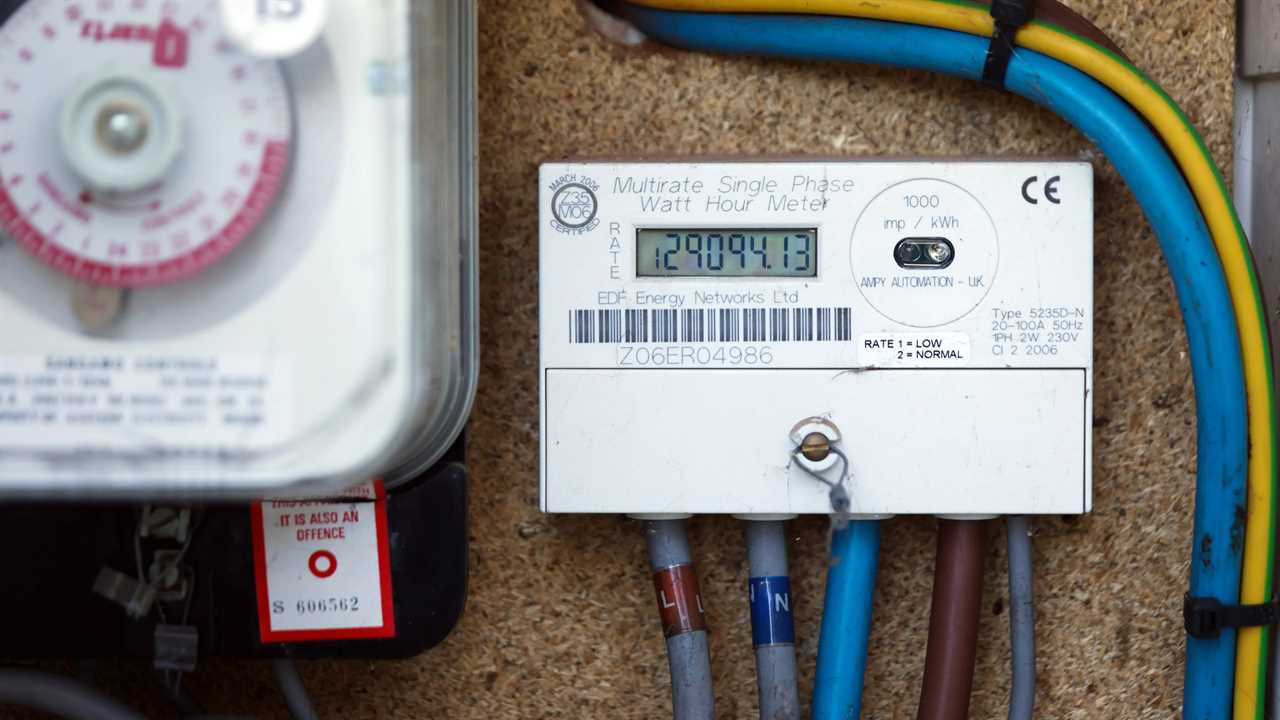

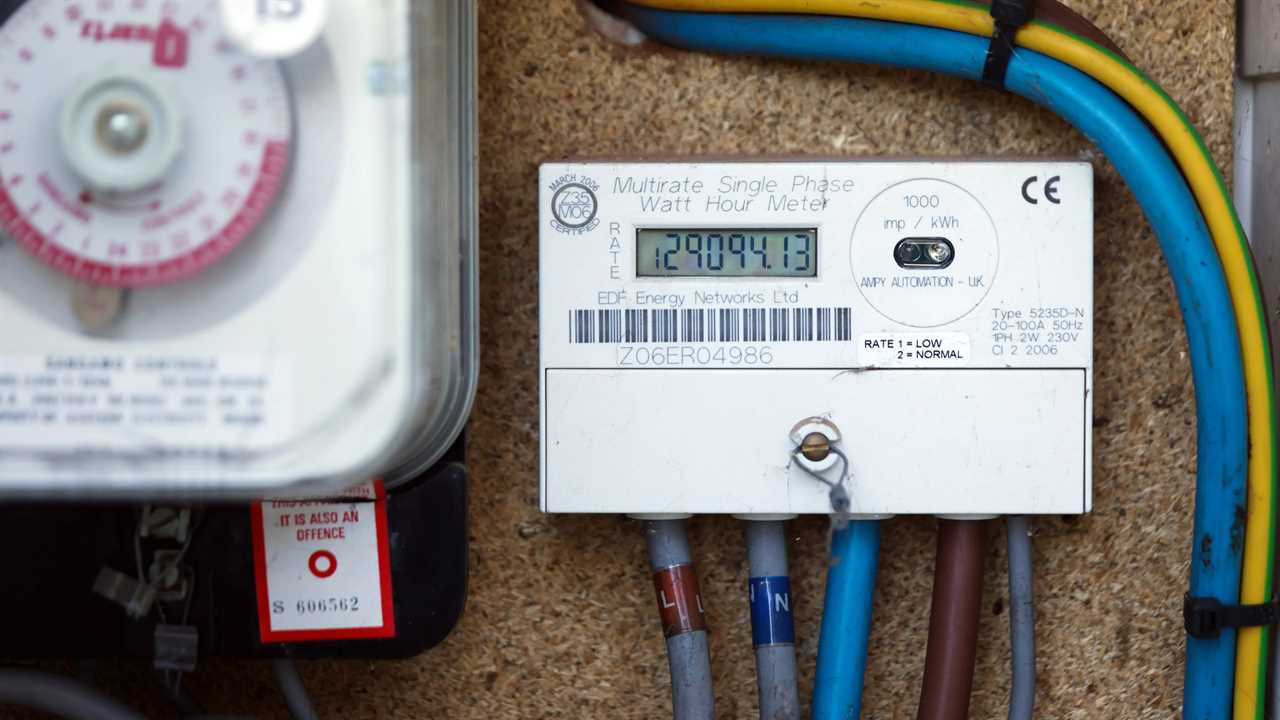

Households need to send in a meter reading to ensure accurate billing

Under the new cap, the average household is expected to spend £1,849 a year on energy bills, up from £1,738 previously.

This threshold indicates the typical annual expenditure on energy, though actual costs will vary based on individual usage, potentially being higher or lower than the set rate.

The threshold targets the 22 million households on standard variable tariffs, which are subject to changes every three months in line with wholesale energy prices.

Conversely, households on fixed tariffs pay a consistent rate for the contract's duration and are exempt from the price cap adjustments.

To prevent overcharging, it's important to submit a meter reading to your supplier before the new price cap is implemented.

Providing an accurate meter reading ensures that energy used prior to April 1 is billed at the previous rate.

The deadline for submitting meter readings varies by supplier, with some allowing backdating submissions or offering an extended window for sending in readings.

Failure to meet the deadline will result in an estimated bill based on presumed energy usage, potentially charging energy used before the cap increase at the higher rate. This could lead to overbilling.

Below are the specific dates by which major energy providers require meter readings ahead of the rate increase.

Deadline Dates for Submitting Meter Readings

It's advisable to take a meter reading near April 1 to accurately reflect energy consumption up to that date.

After recording the reading, you must send it to your supplier within the timeframe they specify.

The deadline varies by provider. For example, British Gas customers must submit their reading by April 14, which can be done online, through the app, by phone, or via a web form.

Ovo Energy requires submissions by April 11, accessible via their online account, mobile app, or telephone.

E.ON Next customers need to provide their meter reading by April 6, which can be done through their online platform, app, phone, or email.

Households supplied by Octopus Energy have until April 8 to send their readings online, through a web form, via the app, or by email.

EDF customers must submit their meter readings by April 10, available through various channels including online, app, web form, WhatsApp, text, or phone.

Utility Warehouse allows submissions in the five days leading up to April 1, which can be done through their online account, app, or by phone.

Submitting Your Meter Reading Made Easy

The simplest method to record your meter reading is by photographing your gas and electricity meters, providing proof in case of billing disputes.

Most suppliers offer the option to submit readings online via your energy account.

Other options may include sending readings by text or through the supplier's mobile app.

Check your supplier’s website for available submission methods.

Understanding Your Electricity Meter

Digital electricity meters display six numbers, with five in black and one in red. Only the five black numbers should be recorded, from left to right.

If you have an Economy 7 or Economy 10 tariff, which offers cheaper electricity at night, your meter will show two sets of numbers. Both sets are required for an accurate reading.

For traditional dial meters, record the first five dials in sequence from left to right, ignoring any red dials. If a dial is between two numbers, note the lower number. If it's between nine and zero, record nine.

Checking Your Gas Meter

For digital metric gas meters showing five numbers followed by a decimal point, record the first five digits.

Imperial digital gas meters display two red numbers and four black numbers; only the four black numbers should be noted.

Follow the same procedure as with digital electricity meters if you have a digital gas meter.

Smart Meters and Automatic Readings

Smart meter users do not need to manually submit readings, as usage data is transmitted automatically to the supplier.

Ensure your smart meter is set to "smart mode" and functioning correctly to guarantee accurate billing.

Frequently Asked Questions

What are the different types of money?

The main types of money include commodity money, which is based on physical goods like gold or silver; fiat money, which is government-issued currency not backed by a physical commodity; and digital currency, which exists electronically and is often decentralized, such as cryptocurrencies.

What is a budget deficit?

A budget deficit occurs when a government's expenditures exceed its revenues over a specific period, usually a fiscal year. This can lead to increased borrowing and national debt if not addressed through spending cuts or revenue increases.

How does inflation affect the value of money?

Inflation refers to the general rise in prices over time, which erodes the purchasing power of money. As inflation increases, each unit of currency buys fewer goods and services, meaning that the value of money decreases in terms of what it can purchase.

How can I budget my money effectively?

To budget effectively, start by tracking your income and expenses to understand your spending habits. Set realistic financial goals, categorize your expenses, and allocate funds accordingly. Regularly review and adjust your budget to ensure it reflects your current financial situation and objectives.

What is the importance of financial literacy?

Financial literacy is essential for making informed decisions about budgeting, saving, investing, and managing debt. It empowers individuals to understand financial concepts, evaluate risks, and navigate complex financial products, leading to better financial stability and long-term wealth building.

What is the difference between saving and investing?

Saving typically involves setting aside money in a secure account for short-term needs or emergencies, while investing involves using money to purchase assets like stocks or real estate with the expectation of generating a return over the long term. Investing carries higher risks but offers the potential for greater rewards.

How can I start saving for retirement?

To start saving for retirement, begin by establishing clear retirement goals and determining how much you need to save. Contribute to employer-sponsored retirement plans, such as a 401(k), and consider opening an Individual Retirement Account (IRA). Regular contributions and taking advantage of compounding interest can significantly boost your retirement savings over time.

Statistics

- The average cost of raising a child in the U.S. is estimated to be around $233,610, according to the U.S. Department of Agriculture.

- According to a survey by the Financial Industry Regulatory Authority (FINRA), about 66% of Americans could not correctly answer four basic financial literacy questions.

- As of 2021, the average American household had approximately $8,400 in credit card debt, according to Experian.

- According to the Bureau of Labor Statistics, the average American spends about $1,500 per year on coffee.

- According to a Gallup poll, 56% of Americans report that their financial situation is better than it was a year ago.

- The average return on investment for the S&P 500 over the past 90 years is about 10% per annum.

- According to the Federal Reserve, approximately 39% of Americans do not have enough savings to cover a $400 emergency expense.

- A survey by the American Psychological Association found that 72% of Americans reported feeling stressed about money at some point in the past month.

External Links

How To

How To Improve Your Credit Score

Improving your credit score is a gradual process that requires consistent effort. Start by obtaining a copy of your credit report from the major credit bureaus to identify any inaccuracies or negative entries. Pay your bills on time, as payment history accounts for a significant portion of your credit score. Reduce your credit card balances to maintain a low credit utilization ratio, ideally below 30%. Avoid opening new credit accounts frequently, as this can negatively impact your score. Lastly, consider becoming an authorized user on a responsible person's credit card to benefit from their good credit habits. Regularly monitor your credit report to track your progress.

Did you miss our previous article...

https://hellofaread.com/money/easter-egg-prices-drop-at-major-supermarket-but-shoppers-remain-unhappy

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions

PoliticsRoyaltySoap OperaGamingMoneyPrivacy PolicyTerms And Conditions