Overview

Rishi Sunak, the UK Chancellor, has released his tax returns for the previous year, revealing that he paid more than £500,000 in taxes. This amount represents an effective tax rate of 23% on his earnings of £2.2 million. The majority of his income came from capital gains on assets, totaling £1.8 million. Sunak's tax returns also showed that he paid separate taxes in the US, where some of his investment income and capital gains were generated.

The Numbers

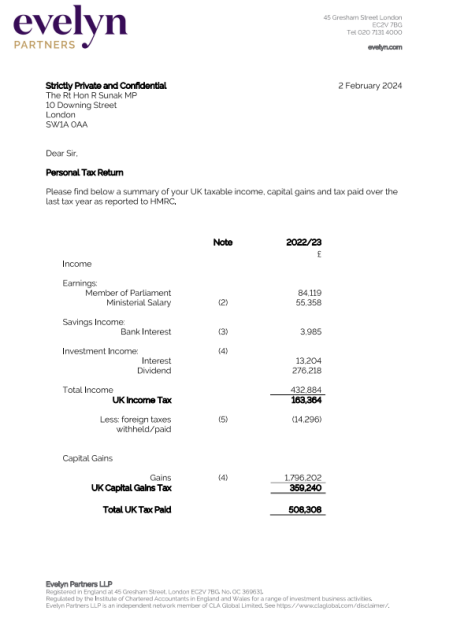

According to Rishi Sunak's tax returns, he paid £508,308 in taxes on his earnings of £2.2 million. This translates to an effective tax rate of 23%. The bulk of his income, £1.8 million, was from capital gains on assets, which increased from £1.6 million the previous year. In addition to his investment income, Sunak received a salary of £139,000 as an MP and minister.

American Connections

All of Rishi Sunak's investment income and capital gains came from a blind trust associated with a US-based investment fund. As a former resident of California, Sunak also paid separate taxes in the US. He paid $6,847 in taxes from $45,646 in dividends, which were taxed separately in the US in 2022.

Wealth and Transparency

Rishi Sunak and his wife, Akshata Murthy, have an estimated wealth of £529 million. In an effort to promote transparency, the Chancellor committed to publishing his tax returns. However, these documents have come under scrutiny after Sunak made a £1,000 bet on Rwanda flights taking off before the election, leading to accusations of being out of touch.

Jeremy Hunt's Tax Returns

In addition to Rishi Sunak, Chancellor Jeremy Hunt also released his tax returns. Hunt's documents showed that he paid £117,418 in taxes from an income of £416,605.

Did you miss our previous article…

https://hellofaread.com/politics/warped-putin-accused-of-spewing-lies-about-boris-and-ukraine/