CREDIT scores are like Uber ratings – you’re forever chasing the full five stars but it only takes one bad experience for it to all come tumbling down.

The consequences are far greater. A black mark on your credit report can stop you from getting a mortgage, personal loan, credit card or even a mobile phone contract.

I boosted my credit score by 131 points in 30 secondsAs Deputy Digital Consumer Editor of HOAR I am more aware than most about the importance of a decent credit history.

I’m very lucky that mine sits in the “good” category. I regularly check it and I’ve never had any cause for concern. Until recently.

I ran a soft check (which doesn’t affect your score) for a 0% interest credit card and I was told I would be rejected for ALL of them.

Instead I was offered a credit builder card with high interest rates.

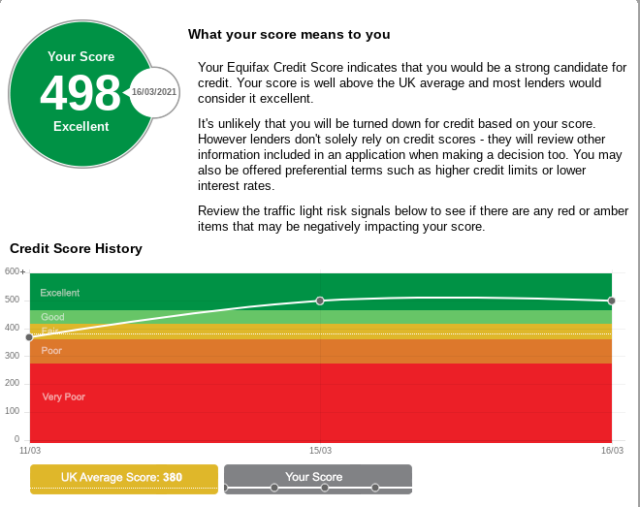

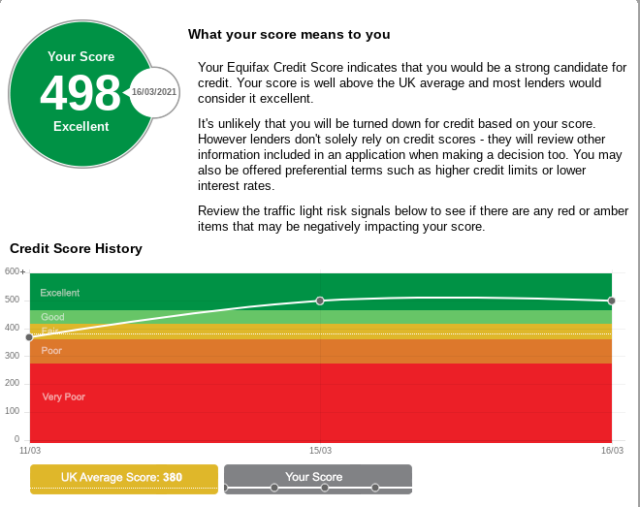

My Equifax credit score put me in the “fair category” when I first checked my report After getting a linked address removed, my report jumped by 131 points

After getting a linked address removed, my report jumped by 131 pointsWhen I checked my score at the three credit reference agencies -TransUnion, Equifax and Experian – I found that they varied widely.

Also a mistake was costing precious points on my score at one of the agencies – and it may be the reason why I wasn’t being accepted for credit that was deserving of my good score.

The three agencies use the same criteria to assess you but banks and lenders may only report to one and they have their own scoring system, which means you have to check all three to get a full picture.

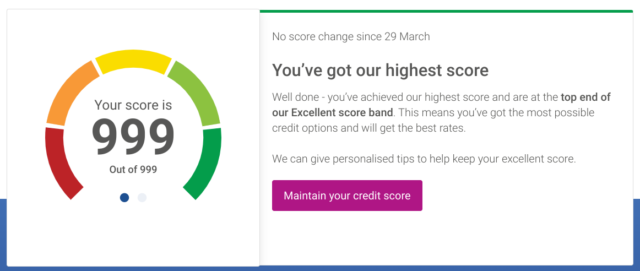

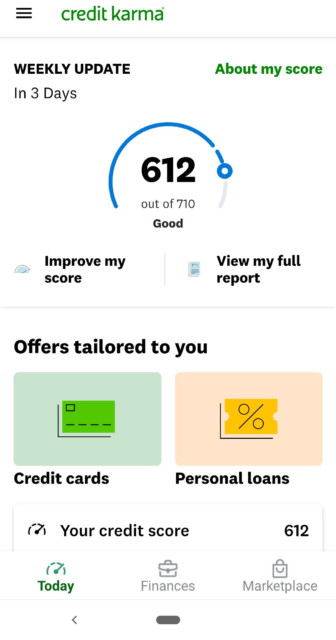

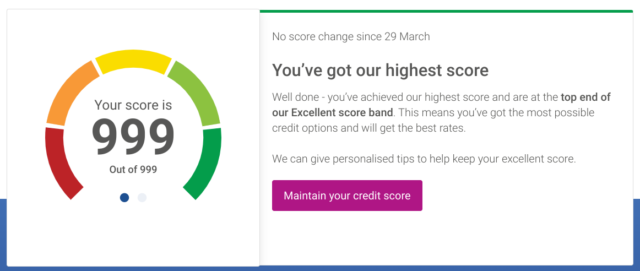

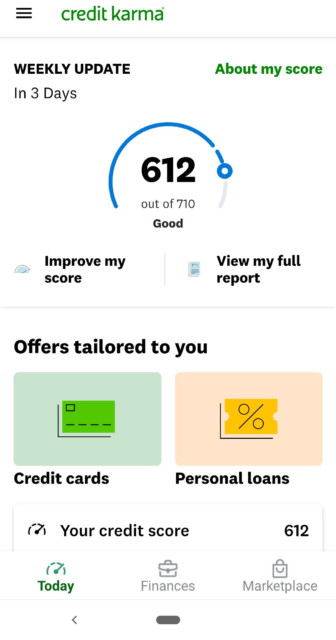

For example, Experian will rate you on a scale of 0-999, Equifax from 0-700 and TransUnion from 0-710.

My Experian score is an impressive 999 putting me in the “excellent category”, while TransUnion rates me as good with 612.

But I was shocked to see that Equifax had scored me 367 putting me at the bottom end of the “fair” group.

I asked credit expert John Webb from Experian to assess my scores. He pointed out that my Equifax score has linked me to an incorrect address – another flat in my block.

I called Equifax and they explained that the address may have been pulled through wrong.

They said this can sometimes happen with flats as different companies format addresses differently. They need to investigate.

A member of their customer service team phoned me back a few days later and confirmed they’d made a mistake.

It then took them 30 seconds to correct it and my score immediately shot up to 498, putting me firmly in the excellent bracket.

How to check your credit score for free

Experian lets you check your credit score for free when you register an account but charges £14.99 a month to view your report.

Meanwhile, Equifax charges £7.95 a month to view your score and report, while TransUnion costs £14.99 a month for both.

However, all three offer a 30-day free trial – remember to cancel before it ends though or your card will be charged.

There are other credit checker services that let you view your files for free too.

For example, Clearscore will show you your Equifax file, while TransUnion has linked up with CreditKarma.

Meanwhile, MoneySavingExpert’s Credit Club will let you view your Experian file.

Remember though, these services can’t change anything on your report – you’ll need to contact the credit reference agency directly to do that.

You’ll need to provide some personal information when registering an account with any credit checker service, such as your income and address – and previous address if you’ve recently moved.

I score an impressive 999 on Experian, which didn’t match up with my Equifax score

I score an impressive 999 on Experian, which didn’t match up with my Equifax score To check my TransUnion report for free, I had to check it via Credit Karma

To check my TransUnion report for free, I had to check it via Credit Karma

How to improve my score

Even though my credit scores are good, John pointed out other ways that I could improve it.

Add old addresses

My parents address, where I used to live, showed up as a linked address with TransUnion and Equifax but not with Experian.

John advised I add some of my older addresses to my profiles to make sure it accurately represents what the lender sees when they run a check.

He said: “It looks like there’s a couple of old settled accounts there, so I’d add it to the profile – this way they’ll show to you.

“It is a “linked address” which means those accounts will show to lenders if you apply for credit.”

Joint bank accounts

Where borrowers have a joint bank account with someone else, lenders may choose to search their report too.

It means if anything flags up on their report, it could affect your application.

While there are some current “financial associations” I’ll need to keep, John flagged one that showed up on my TransUnion report that I had forgotten about.