HARD-PRESSED families face a Black Thursday of financial misery today with a triple whammy of rising interest rates, soaring energy bills and runaway inflation.

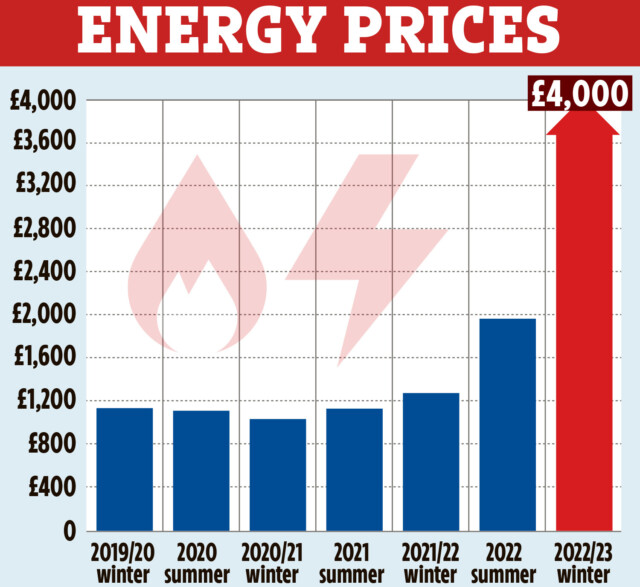

They will see mortgage payments rocketing by an average of £650 a year, with £1,400 added to fuel bills in October, and £250 in January, pushing the total towards £4,000 a year by 2023.

Families face a Black Thursday of financial misery today with a triple whammy of rising interest rates, soaring energy bills and runaway inflation

Inflation is forecast to hit 15% – pushing up the price of fuel and food

Energy regulator Ofgem is set today to lift its price cap to £3,615 in October, with a further £250 rise in January and a promise of reviews every three months

Energy regulator Ofgem is set today to lift its price cap to £3,615 in October, with a further £250 rise in January and a promise of reviews every three months

Thursday’s first bad news is expected to arrive with a 0.5 per cent jump in interest rates to 1.75 per cent

Thursday’s first bad news is expected to arrive with a 0.5 per cent jump in interest rates to 1.75 per cent

The left-right combination will take a £2,300 chunk out of household income — even before a forecast increase in inflation to 15 per cent pushes up the price of food and fuel, leaving many on the canvas.

One economist predicts the cost-of-living crisis is likely to last longer and hit harder than anticipated, while analysts believe that the raft of higher bills will leave one in five households with no savings by 2024.

The day’s first bad news is expected to arrive with a 0.5 per cent jump in interest rates to 1.75 per cent. It will be the biggest since 1995 and clobber many millions of borrowers who hold mortgages.

Bank governor Andrew Bailey indicated last month that he needed to act forcefully on rates in order to prevent runaway price inflation.

He promised no “ifs or buts” in the Bank’s commitment to return inflation to its two per cent target.

It stands at a 40-year high of 9.4 per cent — a jump linked to Russia’s invasion of Ukraine and fears warmongerer President Vladimir Putin will turn off the gas taps to Europe.

Energy regulator Ofgem is set today to lift its price cap to £3,615 in October, with a further £250 rise in January and a promise of reviews every three months.

The Resolution Foundation said yesterday that such rocketing gas costs could push inflation up to 15 per cent next year.

Jack Leslie, a senior economist at the think-tank, said: “With gas prices continuing to reach record levels, both households and businesses will see large increases in their energy bills throughout the winter and into 2023.

“How long this high inflation will last is hugely uncertain but the cost-of-living crisis looks set to last longer and hit households harder than previously anticipated.”

There were also fears that many of the nine million mortgage-payers in the UK — 6.8million of them in England — will struggle to cope with a 0.5 percentage point rate rise.

It could add about £74 a month — or £888 a year — to a typical variable rate mortgage. UK mortgage rates rose at their fastest pace in a decade in the six months to May.

The latest jump will put yet more mortgage-payers long used to low rates in serious difficulties.

Greg Marsh, chief executive of cost-of-living forecast group nous.co, said: “Lenders can and must do whatever they can to help.

“The last thing they need is a flood of damaging and expensive repossessions because borrowers can’t afford the new repayments.”

Sarah Olney, Lib Dem Treasury spokeswoman, said: “This is a hammer blow to homeowners who are already struggling to keep up with sky-rocketing bills.

“The mortgage ticking time-bomb could prove disastrous for families and pensioners facing unimaginable energy bills this winter.”

Concerns were also growing for the millions of householders unable to switch mortgages which are due to expire in the next two years unless they pay punishing exit charges.

Mother-of-two Lydia Joseph, a researcher from Faversham, Kent, pays £1,718 a month on a mortgage fixed at two per cent.

She says that the only way she can get out of her current arrangement is to stump up £12,000 in fees upfront.

She said: “That would wipe out all our savings overnight.

“The whole thing feels like I’m facing down the barrel of a gun.

“But if I don’t forfeit £12,000 now, my monthly mortgage payments next year could be more than half my household take-home pay.

“This situation has not really come up in the past two decades because we’ve had falling or very low interest rates.”