CAR insurance policies have shot up for drivers across the UK – but a small tweak to your application could save you £40.

The average cost for renewed premiums was £436 at the start of 2023, according to the Association of British Insurers (ABI).

You can save money on your car insurance just by tweaking your job title

The average policy price for brand new drivers was higher still at £545, up £14 in just three months to the end of March.

It comes as insurers pass higher energy and repair costs on to motorists.

But there are a number of ways to slash the cost of your premium if you’re worried about suffering a sting to your bank account.

Making just a small tweak to your profession when filling out your application could save you up to £40..

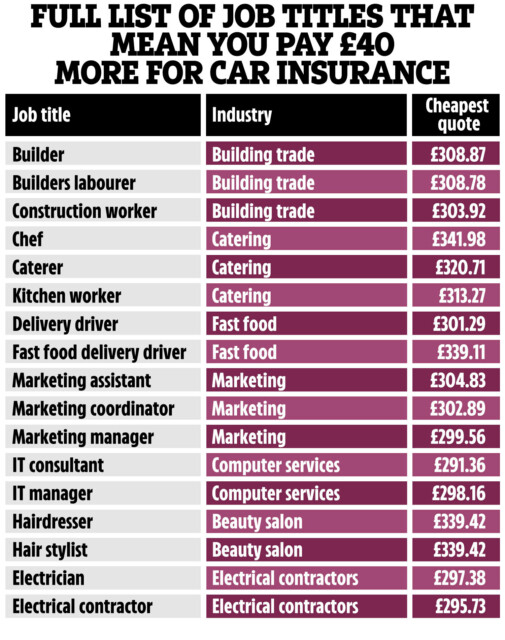

Research from Go Compare has revealed seven sectors where changing your job title slightly can reduce your premium – and it takes just seconds.

The price comparison site found swapping your role from “builder” to “construction worker” can save you £5 a year.

Meanwhile, tweaking it from “chef” to “caterer” can save you over £20.

The biggest saving you can make is changing your role from “fast food delivery driver” to “delivery driver”.

The switch would see you save almost £40.

Don’t get fast and loose though as while you can make smaller changes to your job title, you can’t lie.

You need to be sure that the title you choose is an accurate description of your role.

Ryan Fulthorpe, car insurance expert at Go Compare, warned: “It is worth looking at the wording of your job title to see if you can save.

“When you get a quote, you will likely have to choose from a pre-defined list of jobs and you might find that several titles accurately describe what you do for a living – for example ‘mechanic’ and ‘vehicle technician’.

“If that applies to you, try running quotes for other jobs on the list that are also an accurate description of your occupation as you might find some are cheaper than others.”

How else can I save on my car insurance?

It’s not just making small tweaks to your job title that will save you money on your car insurance.

If you’re coming up for renewal, the exact day you lock in a new policy can save you almost £200.

Meanwhile, if you’re someone who doesn’t use your car that often, it might be worth opting for a pay-per-mile policy.

These charge you based on your mileage, rather than a flat monthly or yearly fee.

Compare the Market found almost one in five motorists who drive less than 4,000 miles per year could save up to £168 on average by opting for one of these policies.

If you’ve already got car insurance and are coming up for renewal, remember that it’s always worth shopping around before it rolls over.

Compare the Market found switching insurer when your policy ends could save you a whopping £400 a year.

There are easy ways to save on other types of insurance too.

We reveal the exact date to take out a home insurance policy and save £60.

Plus, a woman has revealed how she slashed her car insurance by £250 using a little-known trick.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected]

Did you miss our previous article…

https://hellofaread.com/money/major-fashion-chain-to-relaunch-today-before-shops-return-to-high-street-after-shutting-170-branches/