HOUSE prices have risen again in September growing at their fastest rate in more than four years new data from Halifax shows.

And the bank says it received more mortgage applications in July, August and September than at any time in the last 12 years.

House prices have bounced back since the pandemic startedRussell Galley, managing director at Halifax said: “Across the last three months, we have received more mortgage applications from both first-time buyers and homemovers than anytime since 2008.”

The rush of people applying for mortgages comes after the restrictions on moving during the pandemic were lifted and after the chancellor Rishi Sunak introduced a six month stamp duty holiday .

House prices in September were 7.3% higher than the same month last year, a rate of growth not seen since June 2016.

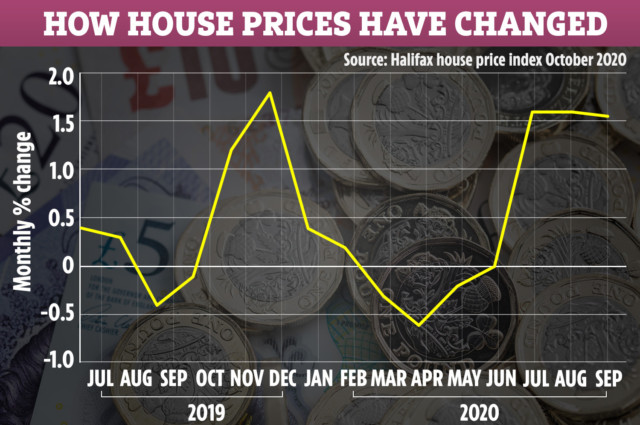

They were also 1.6% higher than August as the property market continued to bounce back from the impact of coronavirus and monthly house prices jumped 1.6% in July and 1.7% in August.

The average house is now £249,870, an increase of nearly £4,000 on the previous month.

Mr Galley said: “Few would dispute that the performance of the housing market has been extremely strong since lockdown restrictions began to ease in May.

“There has been a fundamental shift in demand from buyers brought about by the structural effects of increased home working and a desire for more space, while the stamp duty holiday is incentivising vendors and buyers to close deals at pace before the break ends next March.”

Prime Minister Boris Johnson yesterday announced plans to help first-time buyers on to the property ladder with a new 5% deposit scheme.

Mr Johnson promised to “turn Generation Rent into Generation Buy” speaking at the Conservative Party conference but there has been no detail on how the scheme will work or when it will be available.

Many first-time buyers have struggled to land a mortgage after banks pulled many of the deals designed for those with a smaller deposit.

Buyers have rushed to take advantage of the stamp duty holiday which means they pay no property tax on homes under £500,000.

The Bank of England said approvals for home loans in August were at their highest for 13 years.

Nationwide also found house prices grew at their fastest rate in four year in September, up by 5% on the same month last year.

But there are concerns that this growth will be affected by the end of furlough and support for mortgages and loans being scaled back at the end of October.

Mr Galley said: “It is highly unlikely that the housing market will continue to remain immune to the economic impact of the pandemic.

“As employment support measures are gradually scaled back beyond the end of October, the spectre of increased unemployment over the winter will come into sharper relief.

“While it may come later than initially anticipated, we continue to believe that significant downward pressure on house prices should be expected at some point in the months ahead as the realities of an economic recession are felt ever more keenly.”

House prices are set to fall by nearly 14% next year as the property market feels the impact of coronavirus and the stamp duty holiday come to an end.

You’ve finally scraped enough money together for a deposit, but how do you find the best mortgage deal for your first home? We round-up the best rates currently available for first-time buyers.

Get a foot on the property ladder as house prices boom with our top tips.

Did you miss our previous article…

https://www.hellofaread.com/money/three-mobile-down-hundreds-of-customers-unable-to-make-calls-send-texts-or-use-internet/