DEBORAH Ward eagerly filled out a form on Facebook from a firm promising to help her win back PPI claim cash.

A year later, out of the blue, a letter from HMRC arrived saying she was inline for a a £1,099 refund – but months later she still doesn’t have the cash.

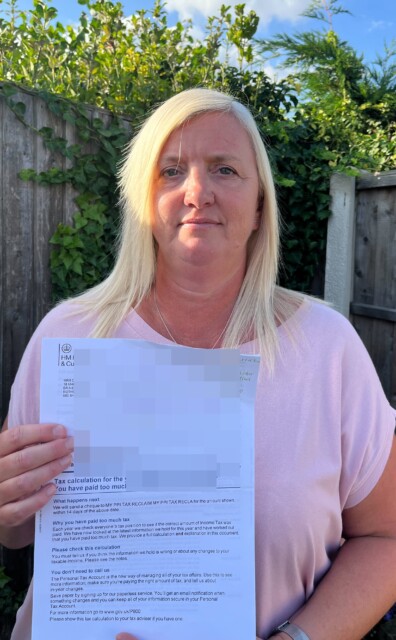

Deborah Ward used a tax reclaims firm to get money back on an old PPI tax claim

Millions of people were victims of being mis-sold Payment Protection Insurance (PPI). It was offered alongside loans, mortgages, credit and store cards, and car finance agreements in the 1990s and early 2000s.

It was meant to cover your payments for a year if you fell ill or lost your job.

But loads of policies were sold to people who would never have been able to claim, while others were paying for the cover without even knowing it.

Millions of pounds of compensation has been paid to victims and while you can no longer lodge a new PPI claim, lenders are still liable to pay back tax which could have been added to payments.

This has lead to an increase in claims firms offering to claw back cash for customers – but they take a slice of the money as a fee.

Deborah has previously made two successful separate PPI claims.

She had been paying for an insurance policy she didn’t need to on a Littlewoods catalogue, and was paying for payment protection insurance she had no idea about on an MBNA credit card.

Deborah got back £1,000 from Littlewoods and a couple of hundred pounds from MBNA.

When Deborah, 48, from Rotherham opened the letter from HMRC she was confused to see that the cheque has been made out to My PPI Tax Reclaim, instead of her.

Months later and after countless unsuccessful attempts to reach out to the firm to get the money she is owed, Deborah is worried she’s been scammed.

“I feel sick knowing someone has got my money. I do think they are a scam company.

“When I phoned HMRC in July, it told me they had already sent a cheque out already in mid-June.

“It gave me two phone numbers for the company – but they weren’t valid, and didn’t exist.

“I phoned up tax office and asked if there was anyway they could put stop on cheque because I was worried I was being conned – but I was told that wasn’t possible.”

“It’s stressful as it’s a lot of money to lose – looking back, I wish I had never done it.”

Claims firms are third party companies are legit companies – but there are limits on how much they can charge, under watchdog rules.

They can’t charge upfront fees and the maximum they can take is 20% (plus VAT) of any refund.

HMRC spokesperson said: “Customers should be careful when responding to online adverts.

“They should check who they are dealing with before they hand over personal information, and should carefully read the repayment agent’s terms and conditions to understand what they’re signing up for, the fees they’ll pay, and the legal agreement they’re signing.

“You can make your own claims direct with us online at GOV.UK or via post. This will ensure you get to keep all of what you are due.”

My PPI Tax Reclaim was contacted by HOAR. HOAR also reported the case to Trading Standards.

Can you claim back tax on a PPI claim?

Since April 2016, people have been able to claim money back on their PPI claims because of the introduction of the personal savings allowance.

This allows basic rate taxpayers to earn £1,000 a year tax-free interest on their savings.

You can reclaim the tax on PPI payments going back four tax years.

If you have used a claims company and think you have been scammed, report it to Action Fraud.

Report it online or by calling 0300 123 2040 (Monday to Friday, 8am-8pm).

It will tell the police and give you a crime reference number.

You should also report it to the FCA.

Money.co.uk personal finance expert James Andrews said: “If a company can get a refund for you, you can get one by yourself too – often for about the same amount of work.

“See if there are any free guides to reclaiming online to help you, if nothing else it will work out cheaper for you and mean you get to keep all of the compensation you’re awarded.”

How to apply for a PPI tax refund yourself

If you think you’ve been charged tax on an old PPI claim, you could be in line for a refund – which you can claim yourself without spending a penny.

You need to fill out an R40 form on the GOV.UK website.

You can make a claim using the online service, or fill in the form on-screen, print it off and post it to HMRC.

To use the online service, you need a Government Gateway user ID and password. This is free to set up online.

If you use the online form, you’ll get a reference number you can use to track the progress of your claim.

Alternatively, you can call the income tax helpline on 0300 200 3300 if you need help submitting your claim.

Did you miss our previous article…

https://hellofaread.com/money/five-tips-to-reduce-waste-by-making-the-most-of-your-bathroom-products/