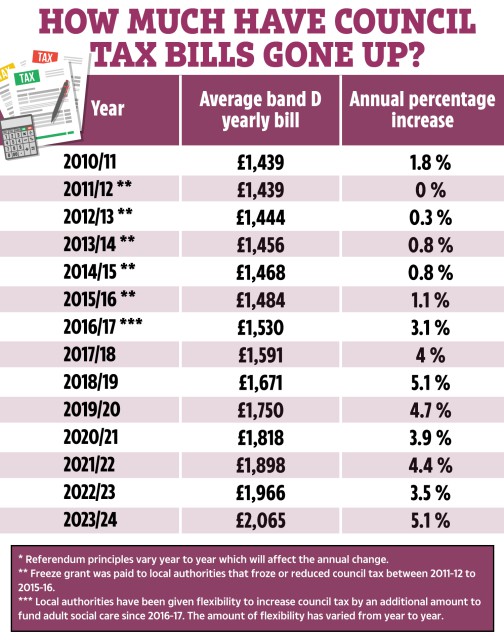

Millions of households in the UK will experience an increase in their council tax bills starting in April, with some areas facing an increase of up to £200. While most local authorities will be allowed to raise the levy by 5%, a few councils have been given permission to increase it by as much as 10%. The exact amount of the increase will vary depending on the property's band and location. Despite concerns about the impact on taxpayers, some councils argue that they need the additional funds to maintain essential services.

Special Permission Granted to Four Councils

Thurrock, Woking, Slough, and Birmingham are among the councils that have been permitted to raise council tax bills by up to 10%. These areas have faced significant financial challenges and require additional funding to continue providing services. While the national limit for council tax increases is set each year by the government, it is up to each local authority to decide whether to implement the maximum increase or opt for a lower percentage.

How Much Will Your Council Tax Bill Increase?

The exact amount of the council tax increase will depend on various factors, including the property's band and the local authority's decision. Residents can check their council's website for information about budget plans for the upcoming financial year, which will include details about any rate hikes. The bill will be sent to residents in April, outlining the amount they need to pay. Payment can be made over 10 or 12 months, depending on the individual's preference.

Support and Discounts Available

Residents who are concerned about the council tax increase can explore various discounts and support options. Single individuals living alone can receive a 25% discount on their council tax bill, while those living with someone who is severely mentally impaired or in an all-student household may be eligible for larger reductions or a 100% discount. Pensioners and low-income households may also qualify for reduced council tax rates. Additionally, residents can challenge their council tax band if they believe they are paying too much.

It is essential for individuals to contact their local council to explore the available support options and discuss any difficulties in paying the increased bill. By being proactive and seeking assistance early on, residents can better manage their finances and potentially reduce their council tax burden.

Did you miss our previous article…

https://hellofaread.com/money/i-love-this-shop-cry-fans-as-department-store-chain-marks-another-branch-for-closure/