THE Chancellor is expected to extend the coronavirus business loan support scheme today to get them through the winter, according to reports.

Rishi Sunak will announce the extra support as part of a wider Winter Economy Plan that will help to prop up the economy during a second wave of Covid-19.

Rishi Sunak is expected to announce a raft of new support measures to get businesses through the winter

As part of the package, he will announce a furlough replacement scheme to help prevent mass job losses when it ends on October 31, and extend the VAT cut for the hospitality industry until March 2021.

Businesses will have until the end of November to apply for the state-backed loans introduced during the first few months of lockdown, according to the Financial Times.

The businesses interruptions loans and Future Fund are currently due to close to new applicants at the end of this month, while the bounce back loan deadline is at the start of November.

The scheme encourages banks to lend to ailing businesses by promising they will be guaranteed by the state.

Figures show that so far it has backed £53billion in lending, £35billion of which is through the bounce back scheme alone.

The extension will give banks until the end of the year to process the applications.

It’s hoped the state-backed cash will help firms get through another period of tighter restrictions as the winter months close in and coronavirus cases soar.

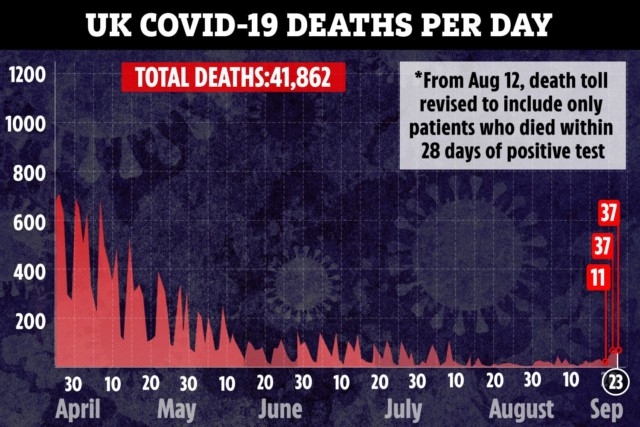

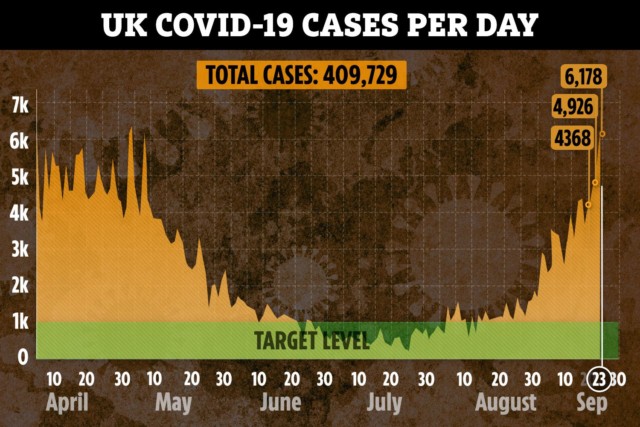

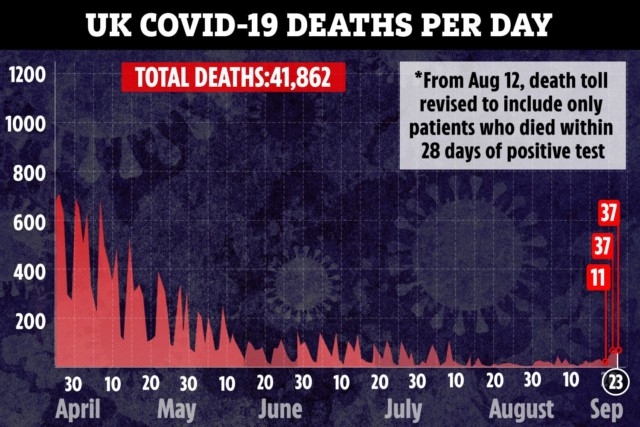

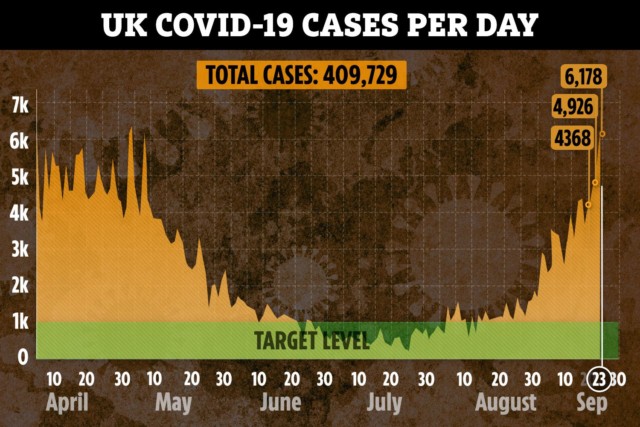

On Monday, Britain’s top scientists issued a Doomsday Covid warning that the nation could face 50,000 new Covid-19 cases a day in just three weeks and deaths will soar if the bug continues to spread at its current rate.

By Tuesday, the PM had brought in stricter measures for England including ordering all retail and restaurant staff to wear masks while at work and slapping a 10pm curfew on pubs.

The government is keen to stave off a full second lockdown over fears it could cause the UK’s economic recovery to stall or even crash again.

Even though the restrictions allow businesses to stay open, it is already having a knock on effect on the economy.