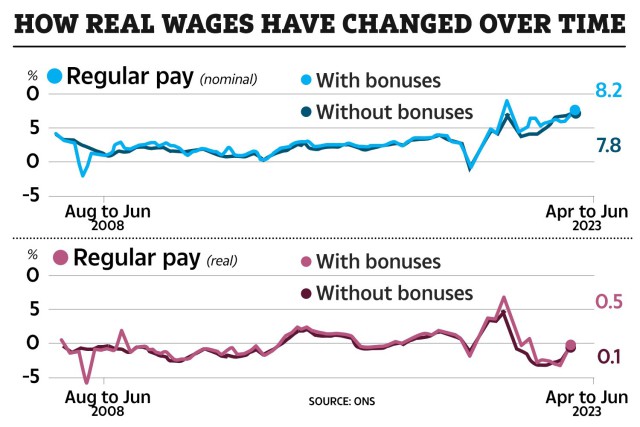

Fastest Rate of Wage Growth on Record

According to the Office for National Statistics (ONS), UK wages have risen at their fastest rate to date. The figures reveal that regular pay excluding bonuses increased by 7.8% in the April to June quarter, marking the highest annual growth rate since records began in 2001. Average total pay, which includes bonuses, saw a growth rate of 8.2%, largely influenced by a one-off bonus to National Health Service (NHS) staff in June. The rise in wages indicates a faster rate of growth compared to previous months.

Recovery of Real Pay

The ONS sees the significant growth in wages, coupled with lower inflation, as a positive indicator for real pay. Darren Morgan, director of economic statistics at the ONS, notes that basic pay is growing at its fastest rate in history. However, after accounting for inflation, wages only rose by 0.5% for total pay and 0.1% for regular pay in real terms. The recent increase in wages could potentially alleviate some of the financial pressure on household budgets.

Unemployment Rate Rises But Pay Growth Prevails

While unemployment rates increased in the April to June quarter, pay growth continued to surge. The ONS reported an unemployment rate of 4.2%, up by 0.3 percentage points from the previous three months. Despite this increase, pay growth remains unaffected and at record levels. Chancellor of the Exchequer, Jeremy Hunt, praised the government's action in the job market, emphasizing that the reforms would support job growth and improve the economy.

Impact on Household Finances

When workers experience a fall in salary in "real-terms," it often signifies that wages are not keeping up with the cost of living. In this case, pay packets are not sufficient to cover expenses such as food and energy prices. Wage growth has consistently lagged behind inflation, resulting in a decrease in purchasing power for individuals. However, the recent drop in inflation rates has relieved some financial pressure on households.

Inflation and Cost of Living

In June, the UK's rate of inflation decreased to 7.9%, higher than expected. At the same time, the Consumer Price Index level of inflation dropped from 8.7% in May. The decline in inflation suggests that the cost of living may finally start to ease after over one-and-a-half years. It is worth noting that grocery inflation slowed down to 16.5%, its lowest level of the year but still one of the highest in 15 years.

Rising Wages and Inflation

Despite the positive impact of rising wages on household incomes, Bank of England (BoE) bosses believe that they may contribute to keeping inflation high. The recent rate hike by the BoE to 5.25%, the highest in 15 years, was primarily driven by concerns over rising wages. Consecutive rate hikes could put additional pressure on homeowners, resulting in higher monthly payments for loans, credit cards, and mortgages. The government has introduced support measures to assist individuals struggling with increased mortgage costs, including extended mortgage terms and interest-only repayments.