THE taxpayer-funded bank running the Government’s emergency coronavirus loans scheme has been blasted — as 22,000 firms are still waiting for a cash lifeline.

The British Business Bank, set up specifically to help small firms, has had 28,460 loan applications since lockdown began.

But just 6,016 have received money.

A similar scheme in Switzerland paid out £12.5billion to 76,000 businesses in the first week. And in America, 177,000 loans worth £26billion were handed out by one bank in a week.

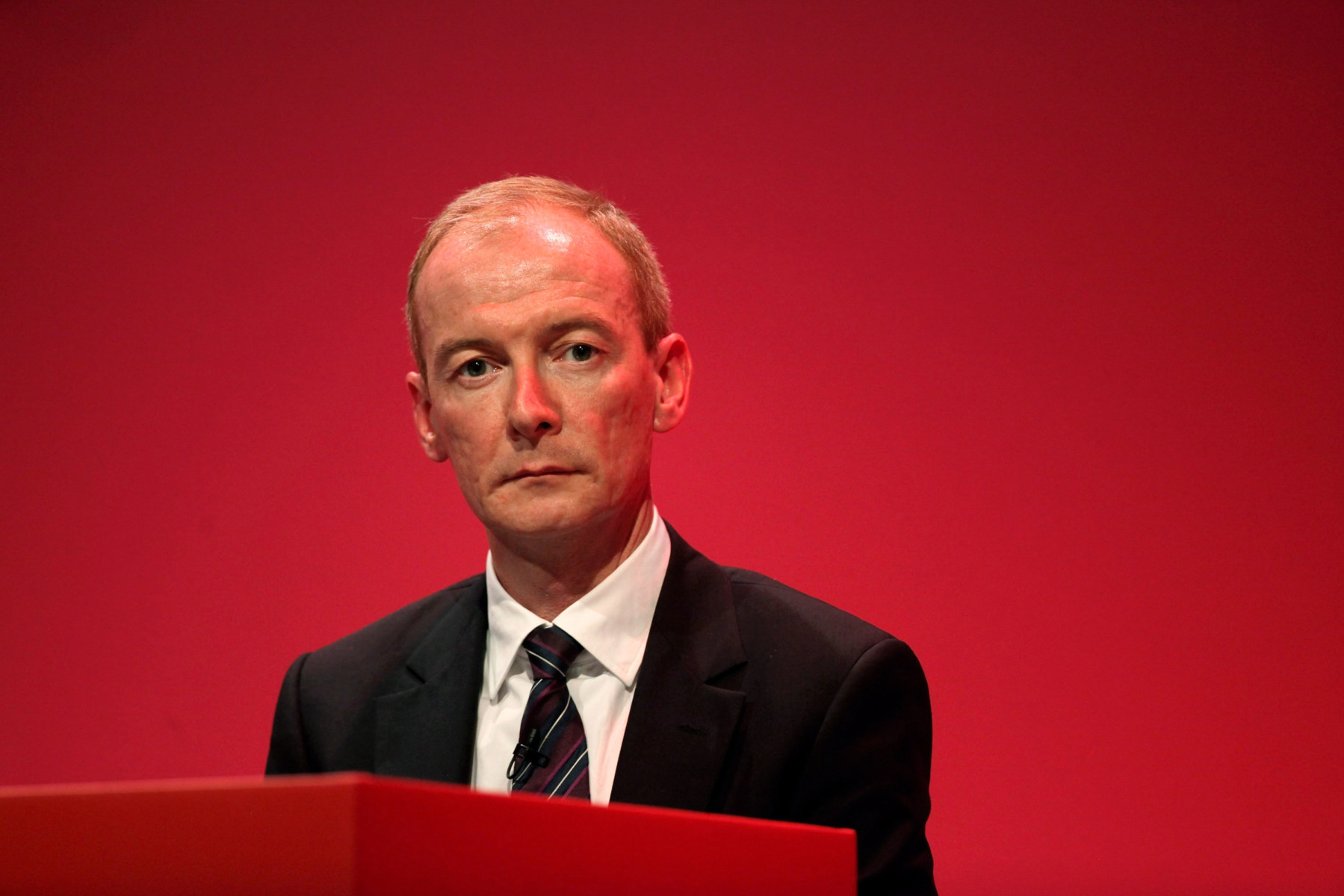

Shadow Treasury minister Pat McFadden said: “The UK still lags far behind other European countries in getting loans to struggling firms.

“We face a looming insolvency crisis if uptake is not improved dramatically.

“The Government must urgently reform the scheme to guarantee 100 per cent loans to small businesses.”

BBB, whose chairman Lord Smith of Kelvin recently sold a £1.4million private Scottish isle, runs the Coronavirus Business Interruption Loan Scheme set up by Chancellor Rishi Sunak.

It underwrites 80 per cent of loans made by its accredited lenders to businesses who are at risk of going to the wall because of Covid-19.

But despite more than 300,000 inquiries, until last week only 200 a day were being signed off.

Struggling firms claim the system is bogged down by form-filling and say the BBB is vastly understaffed.

Following inquiries by HOAR on Sunday, Mr Sunak contacted BBB chief executive Keith Morgan to demand that more is done to speed up the process.

He is due to speak to the bosses of individual lender banks next week in an effort to unblock the system.

When the BBB was set up in 2012, the then Lib Dem Business Secretary Sir Vince Cable promised: “It will be a lasting monument to our determination to reshape finance so it can finally serve industry the way it should.”

But the current delays, during a crisis in which swift action is needed, have led to calls for an urgent overhaul.

Treasury sources now say around 1,000 loans a day are being approved. But the total sum handed out is still less than £1.5billion.

The Chancellor launched the scheme, pledging state-backed loans of at least £330billion, as part of a package to help keep Britain’s 5.8million small businesses afloat.

It encourages banks to lend by offering them a government guarantee for 80 per cent of the loan.

The House of Lords business register says Lord Smith owns a vineyard and guest house in South Africa and has shares in property firms there.

The ex-boss of power firm SSE also owns a large house near Peebles in Scotland and a flat in London. Lord Smith said he sold his island because he “could see pound notes evaporating” when he looked out the window.

He is paid an £89,000 fee to chair the British Business Bank. Mr Morgan is said to earn around £450,000.

A BBB spokesman said: “The British Business Bank does not process the loans being provided. The decision on whether to grant a loan is being done by almost 50 banks and lenders.

“Our role is to provide a government guarantee for 80 per cent of the value of those loans. Our accredited lenders have seen an incredible demand for loans in the past few weeks.

“We are helping to meet that demand by approving additional lenders.”

Bank bosses say the loans are only available to businesses that were viable before the coronavirus outbreak — and not simply to any company in distress.