A Pay Rise Can Go a Long Way

A pensions expert has revealed a secret that could boost your retirement pot by up to £128,000. While a pay rise is a welcome boost in the cost of living crisis, the extra cash could go a lot further if you are able to save it for the future.

Putting Your Pay Rise Into Your Pension

According to Becky O'Connor, director of public affairs at pension platform PensionBee, putting your pay rise into your pension can result in a bigger "pay rise" later on from your pension income. By saving the extra income today, you could be tens of thousands of pounds better off when you retire.

Automatic Enrollment in Workplace Pension Scheme

If you're over the age of 22, you are automatically signed up to your workplace pension scheme through your job. This is separate from the State Pension and money is deducted from your pay unless you opt out. A minimum of 8% goes into the pension, with you contributing 5% and your employer paying at least 3%.

Crunching the Numbers

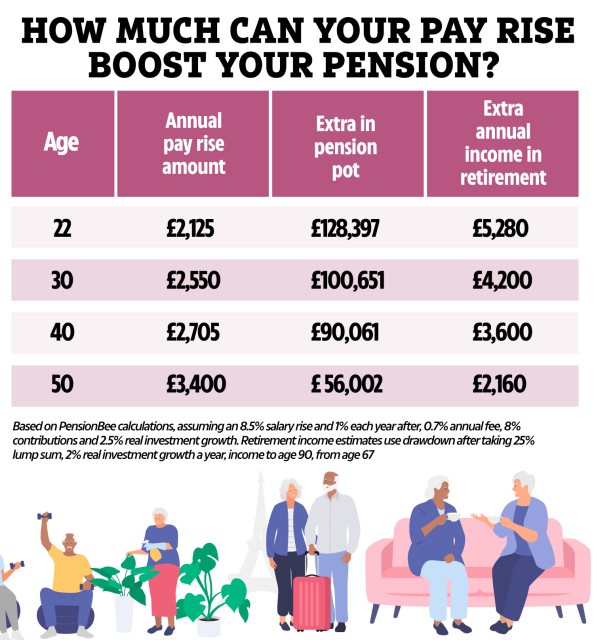

PensionBee calculated the potential boost to your retirement fund based on a person's age. For example, someone who is 22 and adds a pay rise to their pension could see a £128,397 boost. A person who is 30 could turn their current salary into an extra £100,651 when they retire, and a 40-year-old could see over £90,000 added to their workplace pension at 67.

Benefits of Saving in Your Pension

By putting money in your pension, you benefit from tax relief and investment growth over the years. Tax relief means that when you contribute, the government tops up your pension. Your pension is also invested, allowing it to grow over time.

Consider Your Options

Becky advises considering whether you can make the most of a pay rise in the long term by putting it into your pension. Speak to your employer about increasing your contributions or about salary sacrifice schemes. Keep in mind the Annual Allowance, which is the maximum amount you can contribute each year while still receiving tax relief. Even a 1% increase in your contributions could have a significant impact on your pension pot.

Save More for Retirement

You can also save more for retirement by changing how your pension is invested without any extra cost. Stay informed about upcoming changes to auto-enrollment rules and learn how a simple rule could help boost your state pension by £3,000.

Did you miss our previous article…

https://hellofaread.com/money/are-marathon-mortgages-the-answer-for-first-time-buyers/