STRUGGLING Brits are being “tricked” into paying for debt support by ads on Google.

An investigation by HOAR has found copycat debt firms, which have similar names to free charities, pay to appear at the top of search engines.

Struggling Brits could be fooled into paying for “unsuitable debt products”

This is the latest instalment in our Consumer Crew’s Fix Your Finances series, showing you how we will continue to fight your corner.

Charities continue to urge Google to stop copycat firms from manipulating search engine results that risk luring people seeking free debt support into paying for “unsuitable debt products.”

It comes a week after the Advertising Standards Authority banned “misleading” Google ads from two debt companies offering individual voluntary arrangements (IVAs) that could leave hard-up Brits worse-off.

People struggling with debt can access free support from charities such as StepChange, National Debtline and Citizens Advice.

They can provide free advice on managing your debts and help setup payment plans.

But debt firms which charge to set up IVAs often appear at the top of search engines such as Google and Bing instead.

There are no limits on the cost of arranging an IVA and fees can be on average £5,000, according to Citizens Advice.

Yesterday, a report by the City watchdog declared that the IVA market is broken due to “harmful” fee structures.

HOAR first reported on how debt firms are tricking Brits in 2018 but companies are still getting away with posting adverts that appear to be offering free support.

Debt management companies and advisers can legitimately and legally pay to have their advert displayed at the top of search results for certain terms.

Since November 2019, Google has only allowed firms accredited by the Financial Conduct Authority or licensed insolvency practitioners regulated by a recognised professional to pay for adverts related to debt help.

In both scenarios they also need to have been certified by Google and there are strict rules against misrepresenting services.

But in many cases debt firms are using similar names or phrases that campaigners say may fool people into believing they are accessing free support and could end up paying for a more costly IVA or products they do not need.

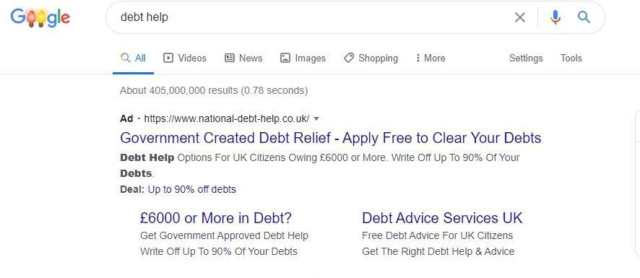

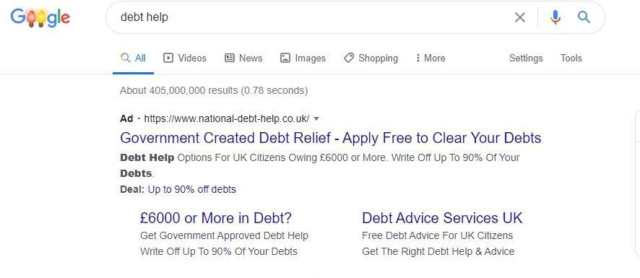

For example, an advert for National Debt Help appeared at the top of search results for “debt support” and “debt help” in December.

It promotes “government created debt relief” and while it offers free advice, the first product it promotes on its website is an IVA.

Google sponsored ads may suggest a company is offering government support A user may think they are accessing government help but could instead be sold an individual voluntary arrangement

A user may think they are accessing government help but could instead be sold an individual voluntary arrangementThe adverts were removed once HOAR highlighted them to Google but other companies now appear with different sponsored adverts in the search results that imply government backing.

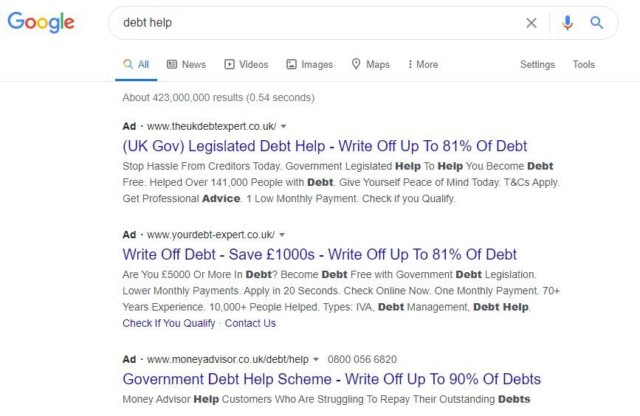

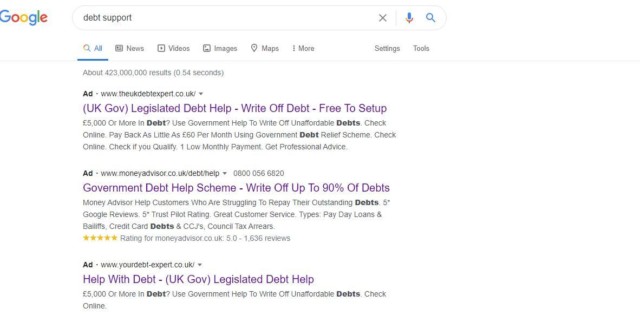

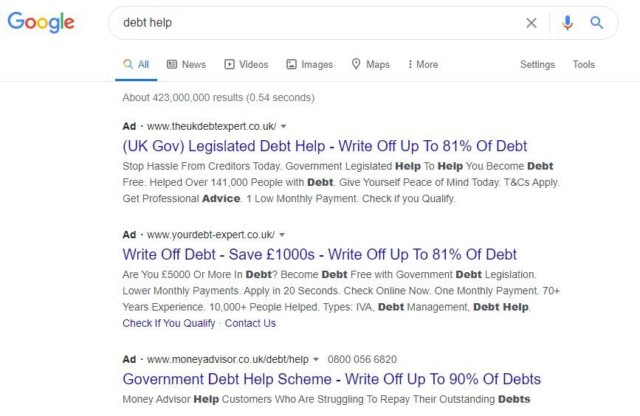

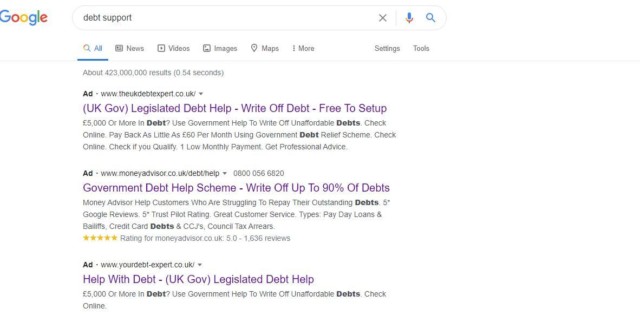

The highest sponsored Google search result for “debt support” and “debt help” at the end of January 2021 was a website called The UK Debt Expert that had the headline: “(UK Gov) legislated debt help – write off debt – free to setup.”

Sponsored adverts for debt companies Your Debt Expert and Money Advisor also appear at the top of the search results and refer to government support.

More copycat firms have appeared despite Google removing “bad ads”

More copycat firms have appeared despite Google removing “bad ads” The sponsored ads often imply that they are providing government help

The sponsored ads often imply that they are providing government help

Sara Williams, a debt adviser who writes the Debt Camel blog, said record numbers of IVAs are failing as people cannot manage the monthly repayments, suggesting they are being mis-sold.

She said: “IVAs are only suitable for a small number of people – most people without assets to protect should not consider an IVA as other options get you out of debt faster and more cheaply.

“If you see an advert for ‘a little-known government debt solution that can write off 80% of your debts’ don’t think that sounds great, remember that other government debt solutions can write off all your debts without you having to make any monthly payments at all.”

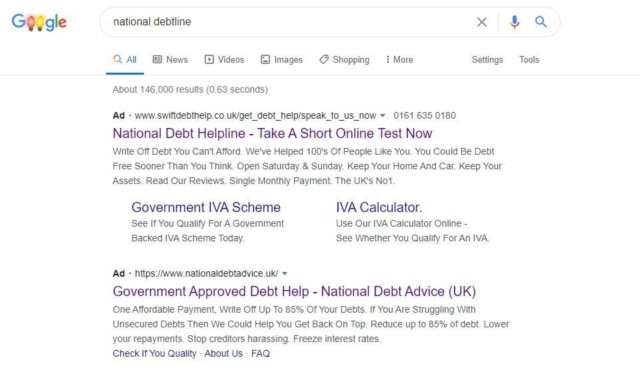

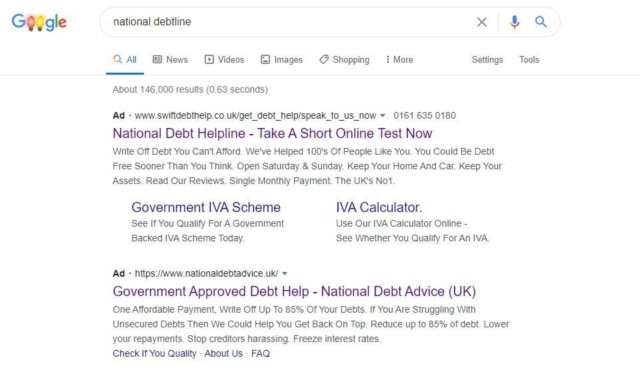

In another case, Swift Debt Help and National Debt Advice appeared at the top of search results for the National Debtline charity, using similar phrases of “National Debt Helpine” and “Government Approved Debt Help.”

Copycat firms will even mimic charities

Copycat firms will even mimic charities

These adverts were removed by Google once HOAR highlighted them to the search engine at the end of 2020 but other similar ads now appear.

Jane Tully, director of external affairs and partnerships at the Money Advice Trust, which runs National Debtline, said it is continuing to see misleading online adverts.

She said: “Regulators and Google have taken some welcome steps to combat the impersonation of debt charities by these firms. However, the number of misleading adverts that remain online makes it clear that more action is required.”

The Mental Health UK charity warns misleading adverts may exploit people when they are at their most vulnerable.