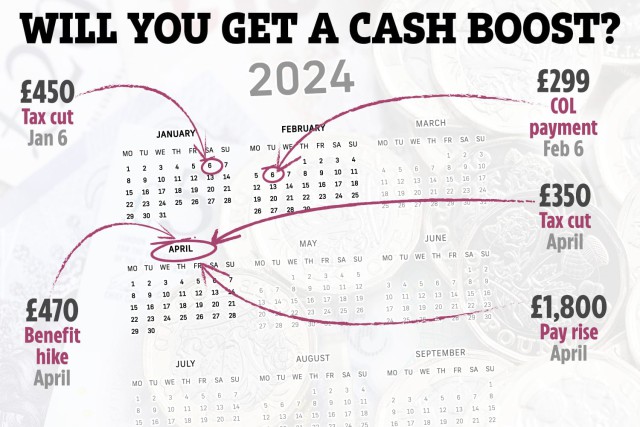

Tax Cut for Workers – £450 Better Off from January 6

In January 2024, millions of workers can expect a tax cut that will put an average of £450 back in their pockets. The main rate of National Insurance Contributions (NICs) will be reduced from 12% to 10%, resulting in significant savings for workers. The exact amount you'll save will depend on your earnings. Read on to find out how much you could save.

Cost of Living Payment – £299 Better Off from February 6

Households on certain benefits, including Universal Credit, will receive a tax-free payment of £299 between February 6 and February 22. This payment won't affect your usual benefits and is designed to help with the cost of living. Make sure you meet the eligibility criteria to receive this boost.

Benefit Hike – Up to £470 Better Off from April

Millions of people on benefits will see an increase in their payments starting in April 2024. Benefit rates will rise by the rate of inflation for September, which is 6.7%. This means you could be up to £470 better off each year. Find out which benefits will increase and if you qualify for the boost.

Tax Cut for the Self-Employed – £350 Better Off from April

In addition to the NIC rate reduction, the self-employed will also get a tax cut in April 2024. Class 4 NICs will be abolished, resulting in an average saving of £350 per year. If you're self-employed, this change will put more money back in your pocket.

National Living Wage Rise – £1,800 Better Off from April

Next April, workers on low incomes will see a significant increase in the National Living wage. For those over 21, the minimum wage will rise from £10.42 to £11.44. This means almost three million workers can expect a 10% boost to their pay packets, or £1,800 per year for full-timers. Find out how this wage increase will benefit you.

Rent Help Increase – From April

Renters on benefits will receive more help with housing costs starting in April 2024. The government will increase the Local Housing Allowance (LHA) to cover the cheapest 30% of local market rents. This means you may be able to cover your entire rent with housing benefit if you're renting a home in the cheapest 30% of private rental properties in your area. Check your LHA rates and explore other options for assistance if needed.

In 2024, there are several opportunities for you to receive cash boosts and have more money in your pocket. Take advantage of these changes and make sure you're aware of the eligibility criteria. Don't miss out on these financial benefits!

Did you miss our previous article…

https://hellofaread.com/money/mum-uses-clever-budgeting-hack-to-save-1400-on-christmas-presents/