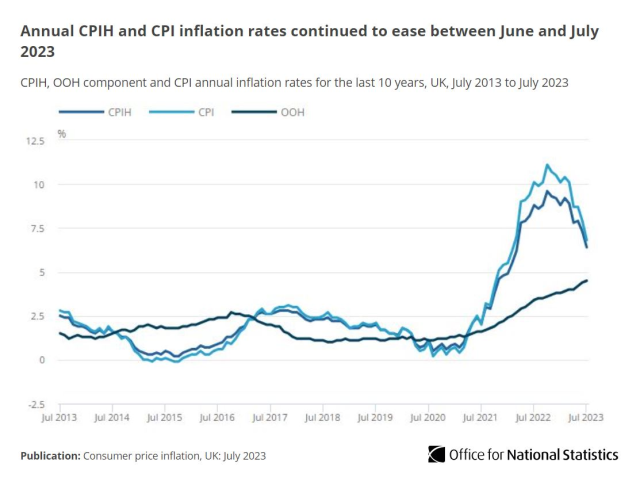

The latest official figures from the Office of National Statistics (ONS) show that the UK inflation rate has fallen again, dropping to 6.8% in July.

Prices rising, but at a slower rate

The consumer price index (CPI) measure of inflation decreased from 7.9% in June to 6.8% in July. While prices are still rising, the rate of increase has slowed down.

What is inflation?

Inflation is a measure of how the price of goods and services has changed over the past year.

Matthew Corder, ONS deputy director of prices, explained that the recent decline in inflation can be attributed to the reduction in the energy price cap, resulting in lower gas and electricity prices. Additionally, food price inflation has eased, especially for items like milk, bread, and cereal. However, higher service prices offset the falling cost of goods.

Positive impact on your money

When inflation decreases, it means that prices are still increasing, but at a slower pace. Chancellor of the Exchequer Jeremy Hunt stated that the government's efforts to combat inflation have been successful, as the rate is now at its lowest level since February last year. However, he emphasized the need to continue working towards halving inflation this year and reaching the 2% target as soon as possible.

Concerns remain

Despite the dip in inflation, Adam Bullock, UK director at TopCashback, warned against being complacent. He noted that although the average figure has dropped, daily expenses such as food, soft drinks, and flights continue to see substantial price increases. The cost of items like live music tickets, toys, and package holidays has also climbed significantly year-on-year. Bullock expressed concern about the impact these price hikes will have on families in the coming months.

Impact on everyday essentials and mortgages

High inflation means that the prices of everyday essentials, including food and energy, are rising. This can reduce the purchasing power of consumers. The Bank of England (BoE), the country's central bank, has the ability to raise its base rate in an effort to curb inflation. While a higher base rate can benefit those with savings, it also leads to an increase in mortgage interest rates, putting pressure on homeowners.

Bank of England's inflation projections under scrutiny

The Bank of England has faced criticism in the past for inaccurate inflation projections. This highlights the importance of monitoring and reassessing their methods to ensure more accurate forecasts in the future.