SAVVY savers are locking their money away to take advantage of high interest rates. Despite the cost-of-living crisis, savers poured £23.4billion into fixed-term savings accounts between July and September, according to figures from the Bank of England. This was up £15billion compared with the same period last year.

Locking in High Returns

Money kept in fixed-term savings is locked away for a set period of time, but you tend to get a higher interest rate than with more flexible access accounts. The best fixed deals now pay almost six per cent interest compared to around four per cent this time last year and just 0.9 per cent in 2021, according to finance data company Moneyfacts.

The 'Laddering' Strategy

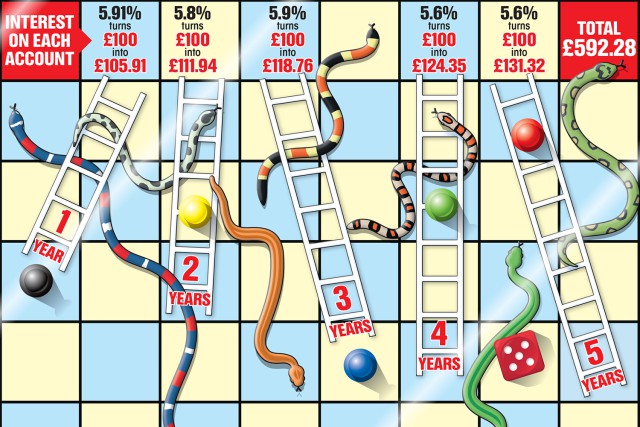

To make the most of high returns while keeping some cash free, a new "laddering" savings strategy is gaining popularity. It involves dividing your money across several savings accounts with different fixed terms. When each deal comes to an end, you can choose to withdraw the cash or reinvest it in the best deal at the time.

Earn Hundreds in Interest

If you divide a savings pot of £5,000 equally between the best five different length accounts, you could earn £922.71 in interest, according to calculations by Interactive Investor. Putting £100 into each of those accounts could earn you £92.28 in interest.

Caution: Pitfalls to Avoid

There are some common pitfalls to watch out for when hunting for the best returns on cash. Many savers lose out by sticking with their favourite high street banks even when challenger banks are offering far better deals. It's important not to be afraid of challenger banks, as they offer much higher rates to attract new customers.

Protect Your Savings

The Financial Services Compensation Scheme protects your money if any UK-authorised bank or building society goes bust. The scheme will pay up to £85,000 for each firm you hold money with, or £170,000 for joint accounts.

Start Saving with a Goal in Mind

If you're new to saving, start by setting a goal you want to work towards. It can be much easier to save when you know what you're aiming for. Open a dedicated savings account to put money in so you aren't tempted to spend it. Set an amount you want to save each week or month, no matter how small. You can always increase it when you're in the habit of saving.

Real-Life Success Story

Mum-of-four Heidi Flaherty, 28, switched banks to pocket nearly five times more interest on her savings. The move also earned her a £200 joining bonus – and she now says switching is her new side hustle that will pay for Christmas.

Did you miss our previous article…

https://hellofaread.com/money/shoppers-rush-to-buy-discontinued-caramac-bars-at-iceland-for-just-1-25/