Renters who receive benefits will see a significant increase in their payments starting in April, aimed at helping them cope with skyrocketing housing costs. This boost comes in the form of Local Housing Allowance (LHA) rates, which will be raised for the first time since April 2020. The LHA sets the maximum amount that individuals renting from private landlords can claim in Housing Benefit or Universal Credit. Rates will be increased to cover the cheapest 30% of local market rents in the 12 months prior to September 2023, after being frozen since 2020.

Who Will Benefit?

The goal of the allowance is to ensure that individuals renting homes among the cheapest 30% of properties in their area can cover their entire rent with their benefit payments alone. However, the exact amount that can be claimed for housing costs depends on the location and size of the rented property. Rates are set differently for shared, one bed, two bed, three bed, and four bed accommodations.

The majority of households in the UK live in three-bedroom properties, according to the Office for National Statistics (ONS).

How Much Could You Receive?

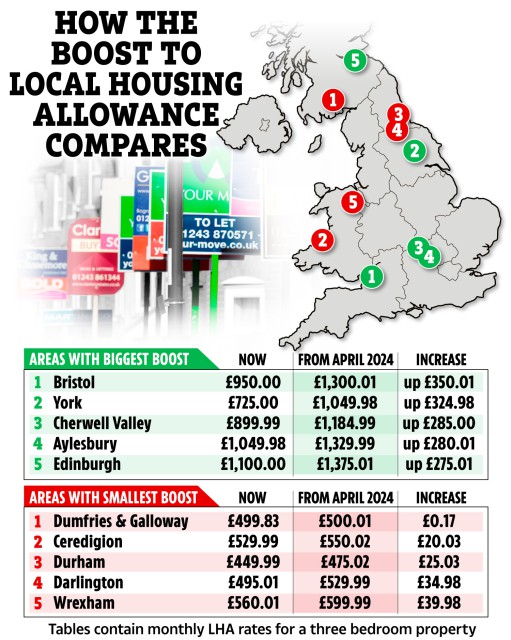

The increase in LHA rates will benefit over 1.6 million families, providing a typical renter with at least £800 more per year towards their housing costs, according to the Department for Work and Pensions (DWP). Some areas will see significant boosts, such as Bristol, where those living in a three-bedroom property could see their rates rise by up to £350.01 per month or a whopping £4,200.12 per year.

Expert Concerns

While the LHA rate increase is welcome news for low-income renters, some experts argue that it may still fall short for some families. The way the rates are calculated means that they may not cover many households' rental costs, as rents have continued to rise since the rates were announced in September. Rent increases from September to April are not factored into the rates, and some of the data used to set the new rates is from as far back as October 2022, when rents were lower than projected for April.

Other Forms of Help

Although the LHA boost is beneficial, there are other forms of assistance available for struggling renters, such as discretionary payments. Renters can check their LHA rates on the government website at lha-direct.voa.gov.uk.

About Local Housing Allowance

The Local Housing Allowance (LHA) sets the maximum amount that individuals renting from private landlords can claim in Housing Benefit or Universal Credit. Around 38% of England's 4.6 million private renters receive some form of housing benefit. The amount that can be claimed depends on the location and size of the rented property. LHA rates are typically set on April 1 each year for the following 12 months, but the current rate has been frozen since 2020, despite significant rent increases. It is estimated that 844,000 households now have rents higher than the maximum level that LHA covers.

Other changes to LHA have been gradually rolled back since its introduction in 2008. The allowance initially allowed claimants to keep the difference of up to £15 per week, giving them more income if they chose to rent a cheaper property. However, this policy was scrapped in 2011. Additionally, the government planned to extend LHA to the social housing sector from April 2019, but the proposals were abandoned in 2017.

Did you miss our previous article…

https://hellofaread.com/money/nightclubs-and-late-bars-in-britain-at-risk-of-closure/