Foreign Exchange Firm's Flotation Goes Sour

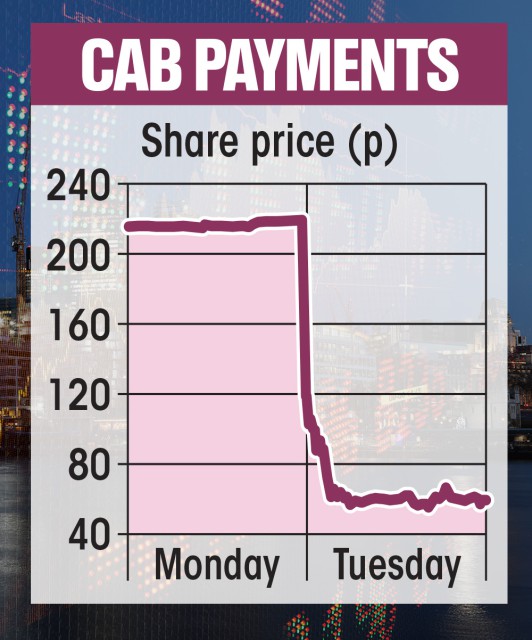

This year's biggest stock market listing, CAB Payments, has experienced a catastrophic crash just four months after its £851 million flotation. The company's shares plummeted as much as 74%, leading to a valuation of just £160 million. The sharp decline follows a major profit warning and has raised questions about the IPO market.

Former Bank of America Merrill Lynch Executive Calls it a "Fiasco"

Craig Coben, the former head of equity capital markets at Bank of America Merrill Lynch, described the situation as a "fiasco" and highlighted the magnitude of the profit warning so soon after the company went public. He also suggested that if CAB Payments had listed in the US, it would likely face an instant lawsuit from investors.

Analyst Brands CAB Payments' Stock "Dead Money"

Nick Anderson, an analyst at Liberum, one of the banks that helped float the firm, stated that CAB Payments' stock is now considered "dead money." This term is used to describe stocks that are unlikely to produce any significant returns for investors.

London's Listing Drought Continues

London has experienced a lack of listings for the past two years, and experts have attributed this to various factors, including a lack of investor appetite, higher valuations of companies, and more enthusiasm for US investments. Negative media attention has also played a role in deterring companies from going public.

CAB Payments Blames Market Conditions and Central Bank Actions

CAB Payments has attributed the decline in trading volumes to changes in market conditions and central bank actions in Africa. The company is uncertain about when the situation will improve. The blow comes despite the company's July prospectus claiming that changes by the Central Bank of Nigeria would align with its assumptions.

Fees Generated by Banks

JP Morgan, Barclays, STJ, Liberum, and Peel Hunt all earned lucrative fees from advising CAB Payments on its IPO. These fees are now being called into question as the company's stock crashes.

Overall Impact on the Market

The crash of CAB Payments' stock has sent shockwaves through the market, raising concerns about the stability of other companies and the IPO market as a whole. It serves as a reminder of the risks associated with investing in newly listed firms.