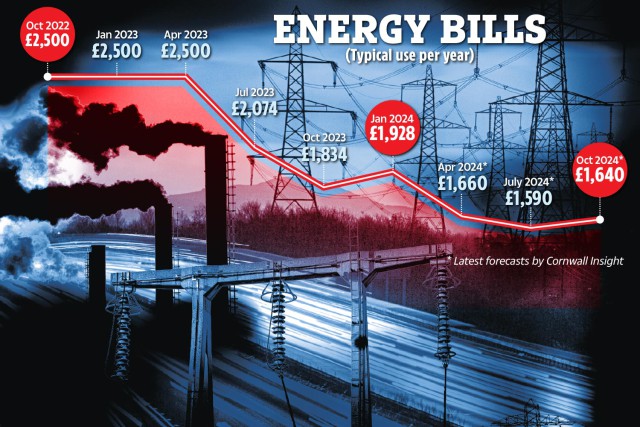

ENERGY bills rose by £94 a year for millions of families on Monday. The January price cap, which remains in place until March, means a typical household will see their annual charges increase to £1,928. Households must choose between agreeing a fixed energy tariff or gambling with a variable rate. It marks the first time that bills have risen since October 2022, now leaving 29million households worse off.

WHY ARE MY BILLS HIGHER THAN THE CAP?

THE price cap by regulator Ofgem sets a ceiling on the amount suppliers can charge for each unit of gas and electricity on the standard variable tariff. Electricity is currently capped at 28.62p per kWh and gas at 7.42p per kWh for those who pay by direct debit. Prepayment meter users also have their prices capped at similar rates. A typical household using 2,700 kWh of electricity and 11,500 kWh of gas will pay roughly £1,928 a year at these rates. If you use more gas or electricity than this, expect to pay more too. Ofgem sets a more expensive price cap of £2,058 for those who pay on receipt of bills by cash, cheque, card or bank transfer due to increased administrative costs.

IS IT WORTH FIXING?

HOUSEHOLDS that lock into a fixed energy deal are charged the same gas and electricity rates during the entire term of the contract. The deals protect customers from bill hikes if Ofgem were to increase the price cap in the future. Natalie Mathie, energy expert at comparison site Uswitch, says: "The energy market remains volatile, so it can be hard to predict whether opting for a fixed deal or sticking with a standard variable tariff will work out cheaper in the long run." But new forecasts by market researchers Cornwall Insight predict that bills will drop by 14 per cent in April and a further five per cent in July.

WHAT ABOUT TRACKER TARIFFS?

CUSTOMERS unwilling to commit to long-term fixed energy deals may want to consider variable tariffs. Kara Gammell, personal finance expert at comparison site Money Supermarket Group, says: "These will almost always be at or below the price cap." For example, E.ON Next’s Pledge variable tariff offers a fixed discount of around three per cent on the price cap rates for 12 months. It will save the average household around £50 a year but comes with a £50 exit fee if you switch before the year ends. The deal is available to both new and existing customers. For a bigger reward but at a higher risk, Octopus Energy offers two variable tariffs which track wholesale gas and electricity costs.

HOW CAN I GET HELP?

ENERGY debt levels rose to a new record of £2.9billion in the last quarter of 2023, Ofgem figures show. If you are struggling to pay your bill, contact your supplier. They may be able to set up a payment holiday or debt repayment plan to help you better manage your cash. Most suppliers, including British Gas, E.ON, and Ovo Energy, also offer grants of up to £1,500 to help hard-up families pay off their debts. Ask your supplier what is on offer and how to apply. If you cannot agree on a way to pay, get help from Citizens Advice by calling 0808 223 113 or at citizensadvice.org.uk. For other support, you can use the benefits calculator at turn2us.org.uk to make sure you are not missing out. And ask your council for local schemes like fuel vouchers and the Household Support Fund.