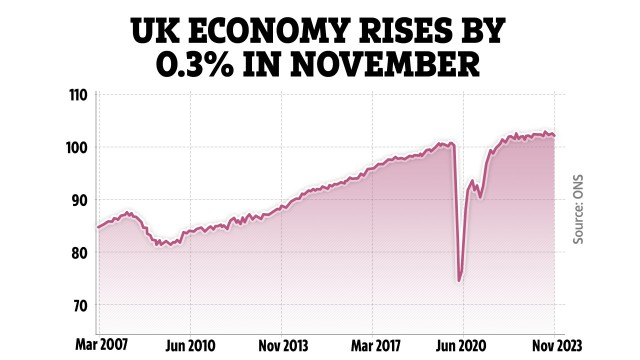

The UK economy has officially entered a recession, with the latest figures from the Office for National Statistics (ONS) showing a 0.1% contraction in December. A technical recession occurs when there are two or more consecutive quarters of falling Gross Domestic Product (GDP). The economy also contracted by 0.3% in the final three months of the year. These figures follow a 0.1% contraction in the previous quarter, and estimates suggest that the economy did not grow at all between April and June before shrinking between July and September. The last recession in the UK occurred in 2020 due to the impact of the coronavirus pandemic. Economists expect this recession to be short-lived and describe the UK's economy as having "stagnated."

What Does It Mean for Your Finances?

In a recession, job losses are common as companies try to cut costs to stay afloat. Businesses may also go into administration or go bankrupt. The government may make cutbacks or raise taxes to shore up its finances, or it may increase budgets to spend its way out of the problem. The number of people in debt and arrears is likely to increase, and there could be more defaults on loans and mortgages, as well as repossessions and bankruptcies.

How to Protect Your Finances

If you're worried about the UK's economic outlook, there are steps you can take to keep your cash safe:

- Review your bank statements and accounts to understand your income and outgoings.

- Cut back on expenses where possible, such as switching to a cheaper mobile phone tariff or canceling unnecessary subscriptions.

- Address outstanding debts and prioritize repayment.

- Seek free debt advice from organizations such as National Debtline, Step Change, or Citizens Advice.

- Check your eligibility for benefits using tools like Entitledto's free calculator or resources from moneysavingexpert.com and StepChange.

- Explore emergency funding options available through local councils to cover essential costs.

It's important to stay proactive and informed about your financial situation during uncertain times. Consider reaching out to your local authority for further assistance and support.

Did you miss our previous article…

https://hellofaread.com/money/new-mystery-fanta-flavor-divides-fans/