Key Takeaways:

– Official figures from the Office for National Statistics (ONS) show that basic pay is still growing.

– Growth in regular pay, excluding bonuses, was at 6.6% in the three months to November.

– Total pay, taking into account inflation, increased by 1.3%.

– UK unemployment rate remains unchanged at 4.2%.

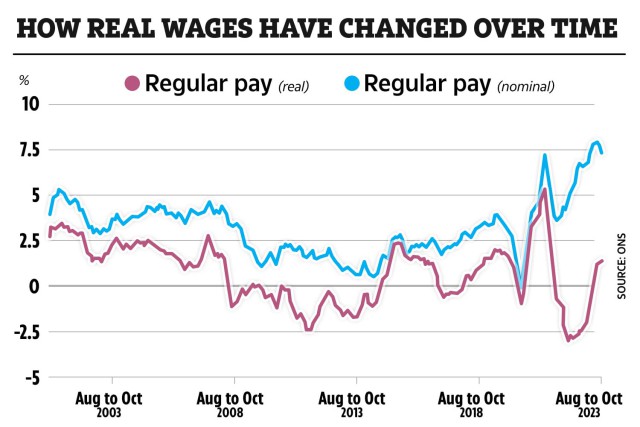

Wages in the UK are on the rise, bringing good news for millions of workers. According to official figures released by the Office for National Statistics (ONS), growth in regular pay, excluding bonuses, stood at 6.6% in the three months to November last year. Although this rate is slightly lower than the previous quarter, it is still a positive sign for workers who have been battling against high inflation over the past year.

Wage Growth Outpaces Inflation

While the rate of inflation fell to 3.9% in the year to November, down from 4.6% in October, wages are now rising faster than prices for the third time since September 2021. This means that workers' incomes are keeping up with the rising cost of goods and services, providing some relief to hard-up households.

Impact on Household Budgets

Rising wages have been blamed for keeping inflation high over the last year, which led to base rate hikes by the Bank of England. However, the latest wage figures suggest that this pressure on household budgets could ease. The Bank may need to consider whether to hike rates or keep them the same as it tries to bring inflation back down to its 2% target.

Real Wage Growth and Tax Cuts

Real wage growth has been positive for the fifth consecutive month, which is encouraging news for workers. Chancellor of the Exchequer Jeremy Hunt highlighted the positive impact of falling inflation on real wages and mentioned the record cut to National Insurance, which will put more money in the pockets of households.

Caution and Future Outlook

While the growth in wages is a positive development, experts caution that households should not expect their cost of living challenges to disappear completely. Inflation is still a concern, and pay rises may be more muted this year as employers strive to keep costs down amid economic uncertainty. It is important for households to prepare their finances for any eventualities and be ready for potential job loss.

Interest Rate Speculations

There are predictions that the Bank of England could cut interest rates as early as spring. This would have an impact on borrowing costs, including loans, credit cards, and mortgage repayments. It remains to be seen how the Bank will respond to the changing economic landscape.

Overall, the rise in wages is a positive development for workers, providing some relief from high inflation. However, caution is advised as economic uncertainties persist and households need to be prepared for any future challenges.

Did you miss our previous article…

https://hellofaread.com/money/martin-lewis-urges-credit-card-holders-to-take-advantage-of-zero-interest-transfers/