COUNCIL tax bills can vary depending on the area where you live.

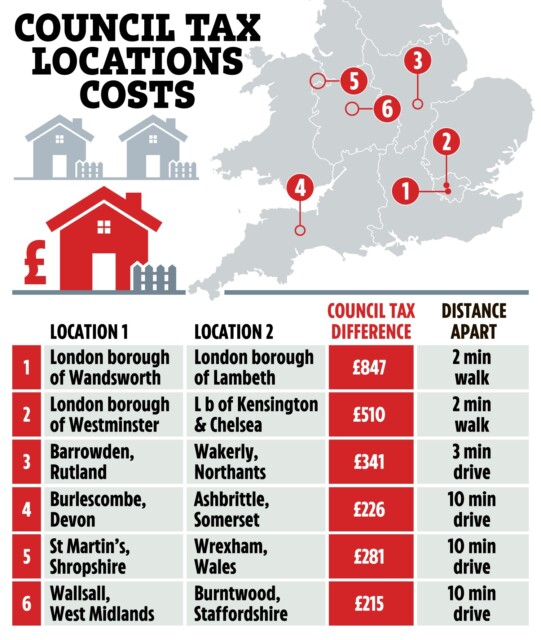

But moving just down the road could add hundreds of pounds to your council tax bill, research by HOAR can reveal.

Moving just a few miles down the road could slash your bills by £800

Council tax paid for the same size homes only a mile apart could vary by as much as £850.

It’s important for renters to check the cost of council tax before they lock into a tenancy agreement, as it can drastically impact their monthly bills.

We looked at ten areas around the country and compared band D properties, which represent the most typical family-sized home.

Council tax bands range from A to H and are based on what a home sold for in 1991.

Band A properties are those which sold for less than £40,000 in 1991 while band H properties are any which sold for more than £320,000.

The average band D council tax bill across the UK is now £2,065, an increase of £99 from 2022/23.

Bills rose more than average this year after councils were given the green light in last year’s Autumn Statement to increase the levy by 5% from April.

London is particularly notorious for its huge range in council tax bills.

And the boundary of its boroughs can fall between one street and the next, so in some cases, you would only need to move a few houses down the road to pay considerably less council tax.

For example, in The London Borough of Wandsworth, a band D home pays just £914.14 a year.

Moving across the border to the neighbouring borough of Lambeth could almost double your annual bill, with band D homes paying £1,761.90 – almost £850 more.

By moving from a home on the edge of the Royal Borough of Kensington and Chelsea to the City of Westminster, you could pay £510 less.

In Westminster, a band D home pays just £912.05.

But homes in Kensington and Chelsea pay £1,422.40 – still far lower than outside the Capital, but considerably more than some of their neighbours.

Outside London, the average difference between addresses was between £200 and £300, but some locations saw even greater disparities.

For example, in the village of Barrowden in the county of Rutland, a band D home currently pays £2,365.56 a year in council tax.

But by moving to the neighbouring village of Wakerly – just a three-minute drive away – you could save £341.

Wakerly is in North Northamptonshire district council, where a band D home pays £2,023.75 a year.

In the South West, we found that by moving from the village of Burlescombe in Devon to Ashbrittle in Somerset, you could pay £226 less.

Burlescombe is part of the Mid Devon district council while Ashbrittle falls under Somserset West and Taunton council.

But the villages are just a ten-minute drive apart and share many of the same local amenities.

A band D home in Burlescombe currently pays £2,259 in council tax, while a home of the same size pays just £2,033.51 in Ashbrittle.

In Shropshire, a band D home in the village of St Martin’s currently pays £2,073 in council tax.

But by moving just over the border to Erbistock, part of Wrexham District Council in Wales, someone in the same sized home would pay £281 less at just £1,792.

In the West Midlands, band D homes in Walsall pay £2,261.05 a year for their council tax.

But by moving slightly further out to Burntwood in Staffordshire, they would pay just £2,046.75 – a saving of £215.

What does council tax pay for?

Council tax pays for local services such as schools, rubbish and recycling collection and street repairs.

The costs can vary dramatically between councils, but bills have generally increased for all areas over the last few years.

Critics say the current system is unfair as it assumes those in bigger houses can afford to pay higher bills, which isn’t always the case.

Everyone also uses the local facilities being paid for, regardless of the size of their home.

Martin Stewart, director of mortgage advice firm London Money, said: “Council tax is arguably an unfair tax burden which links the ability to pay with the value of someone’s property.

“For many, particularly those that have simply lived in areas that have seen house prices rise exponentially, this becomes an issue where they may be asset rich but cash poor.

“The current system is inefficient and needs modernisation.”

How to get help with council tax bills

If you can’t afford your council tax bill, Citizens Advice recommends calling your council to explain. Don’t just stop paying.

Council tax debt in the UK grew to £5.5 billion this year, an increase of £510 million in the last year alone.

But missing just one council tax payment can leave you saddled with having to pay your entire bill for the year up front.

Ask your council if it will let you pay smaller bills over time. You’ll probably be asked to commit to paying a regular amount each month.

If paying your council tax bill means you can’t afford other essentials, such as your rent, tell the council.

If you are on a low income, you may be entitled to Council Tax Reduction of up to 100%, but this varies from council to council and is based on your circumstances.

You can still apply for a reduction if you claim Universal Credit as these are different schemes.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

You can also join our new Sun Money Facebook group to share stories and tips and engage with the consumer team and other group members.