MARTIN Lewis has issued a warning over a Christmas gift that children love – as it could come back to cost them.

Gifts that could get taxed

Martin Lewis, the Money Saving Expert, has shared an important tip for parents as they plan their festive presents. While cash may seem like an easy gift that children are bound to love, it could end up getting taxed and costing families more than they bargained for.

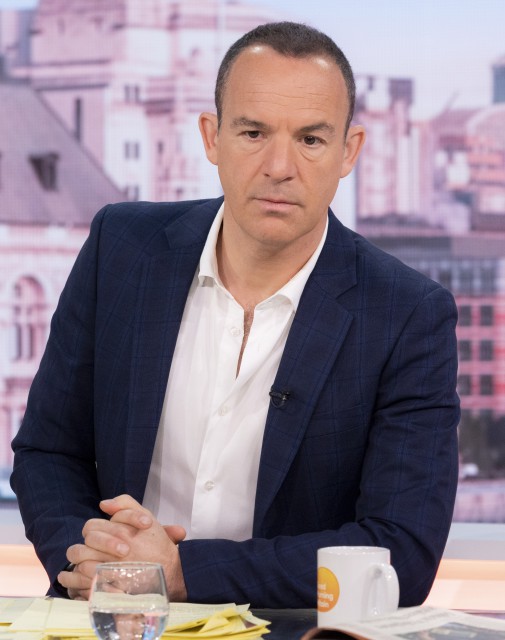

Martin Lewis has offered an urgent warning to parents planning Christmas gifts for youngsters

Tax situation with children

Martin Lewis explains that children pay tax just like adults, but most children don't earn any money. Kids can earn a minimum of £12,500 a year before it's taxed. However, if the gift comes from parents or step-parents and the interest on it is over £100 a year, then it is taxable at the parents' savings tax rate.

Protecting kids from paying tax

If parents are being taxed on their savings and they give money to their kids, a Junior ISA can protect them from paying tax at the parents' savings rate. Martin Lewis advises parents to consider a Junior ISA if they are being taxed on their savings and want to give money to their children.

Money Saving Expert's tips and tricks

Martin Lewis, the Money Saving Expert, is well-known for sharing tips and tricks to help Brits save money and get freebies. Recently, he revealed how people could get a free £50 from a major energy supplier. He also warned energy customers that they may be owed thousands of pounds from their energy provider. In addition, he shared the date when Brits could get £120 worth of No7 products from Boots for just £35. Martin Lewis is constantly on the lookout for money-saving opportunities and offers his advice to help consumers make the most of their money.

Did you miss our previous article…

https://hellofaread.com/money/get-up-to-300-in-food-vouchers-for-tesco-asda-and-iceland/