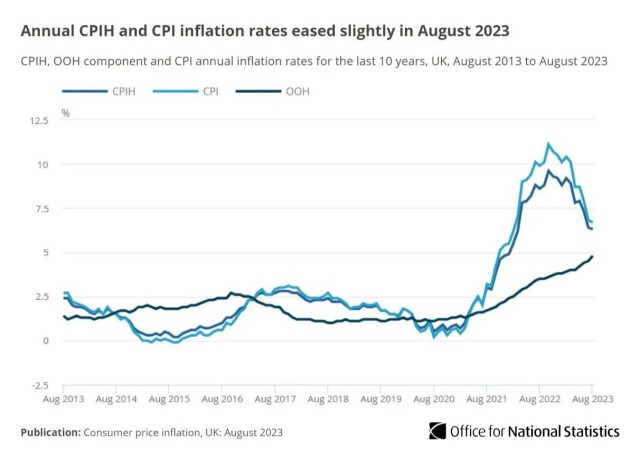

The UK's rate of inflation has fallen again to 6.7% in August, according to official figures released by the Office for National Statistics (ONS). This is a decrease from the 6.8% inflation rate reported in July. The Consumer Price Index, which measures the change in the price of goods and services over the past year, increased by 6.3% in the 12 months leading up to August 2023.

Inflation fell again in August

The ONS published the latest statistics on inflation this morning, revealing a slight decrease in the rate of inflation for August. This can be attributed to a drop in the cost of overnight accommodation and air fares, as well as food prices rising at a slower pace compared to the previous year. However, there was an increase in the price of petrol and diesel, in contrast to the significant decline observed at this time last year.

Chancellor: Plan to deal with inflation is working

Jeremy Hunt, the Chancellor of the Exchequer, commented on the latest inflation figures, stating that they are evidence that the government's plan to tackle inflation is effective. However, he acknowledged that the rate of inflation is still too high and emphasized the importance of sticking to the plan to halve it. By doing so, the aim is to alleviate the burden on families and businesses and create an environment for sustainable economic growth.

These latest inflation figures have significant implications for individuals and the wider economy. As inflation rates continue to fluctuate, it is crucial for consumers to understand how this impacts their purchasing power and financial stability. Stay informed and consider making appropriate adjustments to your budget and investments to navigate these uncertain times.

Did you miss our previous article…

https://hellofaread.com/money/high-street-fashion-retailer-closes-branch-but-shoppers-have-other-options/