THE UK avoided falling into recession in 2022, according to figures released by the Office for National Statistics (ONS).

The ONS said that in the three months to December, gross domestic product (GDP) remained unchanged at 0%.

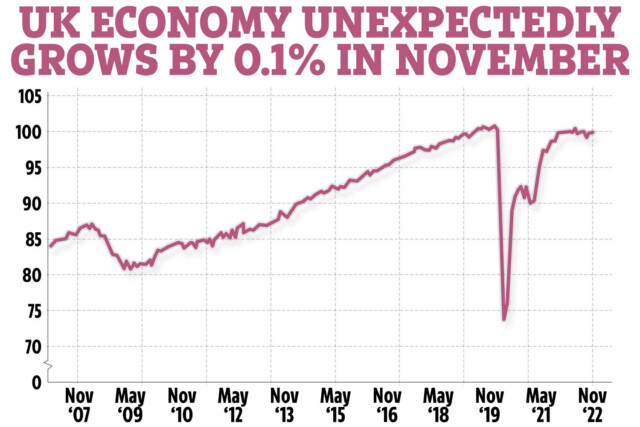

It comes after the UK economy grew by 0.1% in the month to November

But the economy still shrunk by 0.5% in the month to December, new figures reveal.

The fall follows growth of 0.1% in the previous month to November 2022.

GDP measures the value of goods and services produced in the UK.

It also estimates the size of and growth in the economy.

The news comes after Bank of England predicted that GDP would have grown by 0.1% in the final quarter of 2022.

But because GDP remained unchanged in the final quarter of last year, the UK has narrowly avoided a recession for the second time in a year.

ONS director of economic statistics Darren Morgan said: “The economy contracted sharply in December meaning, overall, there was no growth in the economy over the last three months of 2022.

“In December public services were hit by fewer operations and GP visits, partly due to the impact of strikes, as well as notably lower school attendance.

“Meanwhile, the break in Premier League football for the World Cup and postal strikes also caused a slowdown.

“However, these falls were partially offset by a strong month for lawyers, growth in car sales and the cold snap increasing energy generation.”

The country was first spared from recession earlier in the year when the ONS revised its GDP figures for the second quarter.

A country is considered to be in recession when GDP shrinks for two consecutive quarters.

GDP last fell by 0.3% in the third quarter of 2022.

And the Bank of England warned last week that the UK economy will shrink in 2023.

The Bank predicts that GDP will fall in all four quarters of 2023 and into the first quarter of 2024.

It blames high energy prices and the path of market interest rates for reduced economic output

Chancellor Jeremy Hunt said: “The fact the UK was the fastest growing economy in the G7 last year, as well as avoiding a recession, shows our economy is more resilient than many feared.

“However, we are not out the woods yet, particularly when it comes to inflation.

“If we stick to our plan to halve inflation this year, we can be confident of having amongst the best prospects for growth of anywhere in Europe.”

What is a recession?

A country is in recession if there are two consecutive quarters of Gross Domestic Product (GDP) falling.

The year is split into four quarters.

A measure of whether an economy is growing or shrinking is based on something called Gross Domestic Product (GDP).

The economy declined by 0.3% in the third quarter of 2022 but grew in the final quarter – avoiding recession.

Recessions are bad news because they normally lead to job losses and wages stalling.

This then means the government gets less tax, which could mean cuts to services and benefits, or that tax rates go up.

The UK last went into recession in 2020 after the coronavirus pandemic hit, shutting down large parts of the economy.

What does it mean for your finances?

Today’s figures reduce the risk of a deep recession – which is defined as two quarters of shrinking GDP in a row.

But experts have still warned that the nation is heading towards a recession this year as a cost of living crisis continues to cripple millions.

In a recession job losses are common, as companies try to cut their costs to stay afloat.

Businesses may also go into administration or go bust.

The 2008 recession, for example, saw the loss of high street stores including music retailer Zavvi, clothes shop Principles, and stalwart Woolworths.

The Government may make cut backs or raise taxes to try and shore up its finances – alternatively, it may decide to increase budgets to spend its way out of the problem.

And the number of people in debt and arrears is also likely to soar, and there could be more defaults on loans and mortgages or repossessions and bankruptcies.

How to protect your finances

If you’re worried about your finances, there are steps you can take to try and keep your cash safe.

Go through all your bank statements and accounts so you know exactly where your money is going each month.

Of course, there are bills that you can’t avoid paying – but that doesn’t mean you can’t cut back in other ways.

For example, you could save money by moving to a cheaper mobile phone tariff or axing subscriptions you don’t need.

When money is tight, it can be tempting to ignore debts – but this will only make your financial situation worse.

Stay on top of what you owe and always repay priority debts.

There are also plenty of organisations where you can seek debt advice for free.

These include:

- National Debtline – 0808 808 4000

- Step Change – 0800 138 1111

- Citizens Advice – 0808 800 9060

You should also check what benefits you are eligible for.

Entitledto’s free calculator works out whether you qualify for various benefits, tax credits and Universal Credit.

If you don’t want to register, consumer group MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data that let you save your results without logging in.

There is also emergency funding available for struggling households, which is dished out by local councils.

The Household Support Fund is designed to help those in most need with payments towards the rising cost of food, energy, and water bills.

Help available varies, but you could get free cash, food vouchers, and help for bills like rent and energy.

You could also get similar help from your council under the welfare assistance scheme.