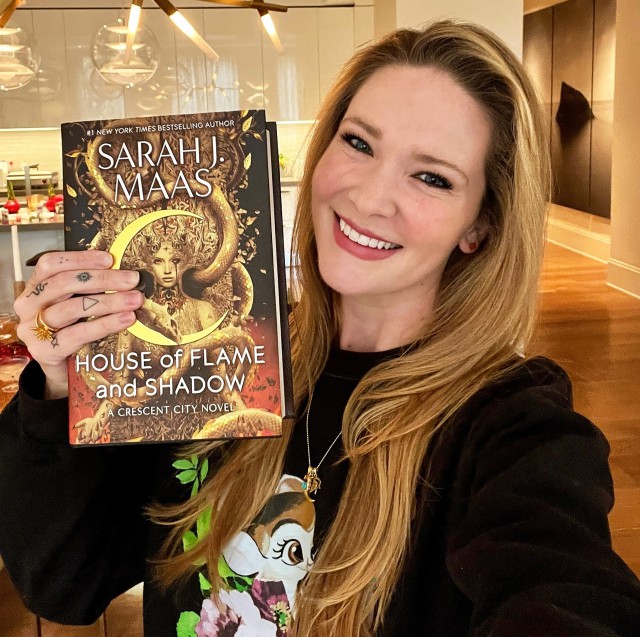

The publisher of the beloved Harry Potter series, Bloomsbury, is experiencing a resurgence in profits, thanks to the success of fantasy fiction writer Sarah J Maas. The company has reported that profits and revenues will exceed expectations as readers eagerly purchase Maas' latest novel, House of Flame and Shadow. This chart-topping book has not only been a hit in the UK, but also in the US, Australia, and other countries, leading to increased sales of Maas' previous works. As a result, shares in Bloomsbury climbed by 7%.

Bloomsbury's Successful Partnership with Sarah J Maas

Bloomsbury is thrilled with its collaboration with Sarah J Maas, who has been a part of the publishing house for over a decade. The company has six more titles in the works as part of its contract with Maas. The fantasy and sci-fi genre has experienced significant growth in the UK, with a rise of more than 50% in the last five years, according to Nielsen Bookscan. Alongside this success, the Harry Potter series continues to be one of Bloomsbury's best-selling collections, with recent top sellers including the gift book The Harry Potter Wizarding Almanac, Ghosts (the companion book to the BBC series), and Pub Kitchen by Tom Kerridge.

Dunelm's Profit Soars as Homeware Retailer Cuts Prices

Homeware retailer Dunelm has reported a nearly 5% increase in half-year profits, reaching £123 million. This surge in profits can be attributed to the implementation of thousands of price cuts. Despite the uncertain consumer outlook, Dunelm has managed to maintain a strong appeal to customers by keeping operating costs under control. The company experienced a 4.5% increase in sales over the past six months, with an average item price of just £14. In terms of volume, sales rose by 6%. Dunelm is pleased with the growing number of new customers and the increased frequency of existing shoppers. The retailer plans to open four new stores this year and another four next year, with a focus on London and Scotland, where coverage is currently lacking. Shareholders will also benefit from a £71 million special dividend of 35p per share, to be paid in April. Dunelm remains on track to achieve full-year profit expectations of £202 million in 2023-24.

Lyft Shares Soar After Cost-Cutting Measures

Ride-hailing firm Lyft experienced a more than 60% surge in shares after an error in its results announcement. The company mistakenly stated that margins would grow by 5%, when the intended figure was 0.5%. Despite the subsequent correction, Lyft's shares still ended the day 16% higher due to positive news regarding successful cost-cutting measures. The company reduced its workforce by 1,200 employees and managed to cut costs by 12% in the previous year.

Average UK House Price Drops by £4,000

According to the Office for National Statistics, the average house price in the UK fell by £4,000 last year, equivalent to almost £11 per day. The typical house price in December 2023 was £285,000, representing a 1.4% decline compared to the previous year. This decrease marks the sixth consecutive month of price falls. While property values dropped by 2.1% in England and 2.5% in Wales, they increased by 3.3% in Scotland and 1.4% in Northern Ireland. London was hit the hardest, with house prices plummeting by 4.8%. Nathan Emerson from Propertymark stated that the disruptive period in the housing market has made it more challenging for people to afford homes, especially during times of economic growth. Additionally, private rental prices paid by tenants rose by 6.2% in the year leading up to January.

Virgin Money Acquires Fund Manager Firm for £20 Million

After five years of collaboration with Abrdn, high street bank Virgin Money is set to acquire the fund manager firm for £20 million. Virgin Money Investments currently manages over £3.7 billion in customer assets and serves more than 150,000 customer accounts. This acquisition aligns with Virgin Money's growth ambitions as it seeks to expand its services and cater to its 6.6 million UK customers.

Coca-Cola's European Bottling Business Achieves Record Profits

Coca-Cola HBC, the European bottling business of Coca-Cola, reported record profits of £815 million, leading to an almost 8% increase in shares. The company experienced a 17% growth in revenue, driven by high demand for its energy drinks and coffee products. As a result, Coca-Cola HBC raised its dividend by 20% after initially predicting a 7% increase in revenues for the year. The recent acquisition of Finlandia Vodka for £153 million is expected to further boost future growth.