Higher Interest Rates Blamed for Corporate Casualties

The number of companies going bust in the UK increased by almost a fifth in August, with higher interest rates being blamed as a main reason for corporate casualties. According to the Insolvency Service, 2,308 companies went bust last month, compared to 1,941 in the same month last year. Some firms are struggling to repay loans taken out during the pandemic to stay afloat.

Wilko Collapse Results in 12,500 Redundancies

Wilko, a prominent UK retailer, recently went bust, resulting in 12,500 redundancies. The company has been broken up, with 122 stores being shared between B&M Bargains and Poundland. Nicky Fisher, the president of UK insolvency trade body R3, stated that August's corporate insolvency figures were the highest for this month in four years, citing long-term economic issues, director fatigue, and creditor pressure as contributing factors.

Company Voluntary Liquidations and Administrations See Significant Increases

The majority of August's insolvencies were attributed to company voluntary liquidations, in which struggling firms choose to shut down. There were 1,880 voluntary liquidations, marking a 13% increase compared to August last year. The number of firms going into administration also saw a significant jump of 68%.

Overleveraged Businesses Struggle Post-Covid

David Fleming, managing director at Kroll, stated that most businesses fail because they run out of working capital, and many companies that emerged from the pandemic were overleveraged. The challenges of repaying debts and maintaining financial stability have posed significant difficulties for these firms.

UK Air Traffic Control Provider Under Fire

The bosses of airlines Ryanair and easyJet have criticized the UK's air traffic control provider, NATS, following staffing shortages that led to more flight cancellations. Ryanair's Michael O'Leary called for the resignation of NATS boss Martin Rolfe, while easyJet's Johan Lundgren accused NATS of letting customers down throughout the summer.

Games Workshop Soars in Value

Warhammer maker Games Workshop has seen a substantial increase in value, now worth £3.8 billion. The company experienced a surge in shares of over a fifth, and it expects profits to grow from £39 million to £57 million this year. The firm's soaring sales of £121 million led to a dividend of 50p per share.

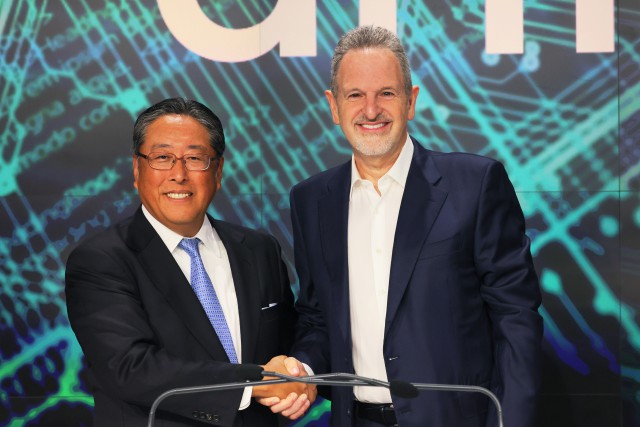

Good Week for Arm Boss, Bad Week for BP Boss

Rene Haas, the CEO of chipmaker Arm, is set to receive a £30 million payday after the company was listed for £43 billion in New York. On the other hand, Bernard Looney, the CEO of BP, has been ousted from his position due to concerns about his personal relationships with colleagues.