HOUSE prices have fallen year-on-year for the first time in over a decade, mortgage costs are spiralling and there are fears of a homebuilding slump.

It’s a perfect storm which has prompted home owners to ask: What’s gone wrong?

House prices slipped by 1 per cent in May compared to the previous year

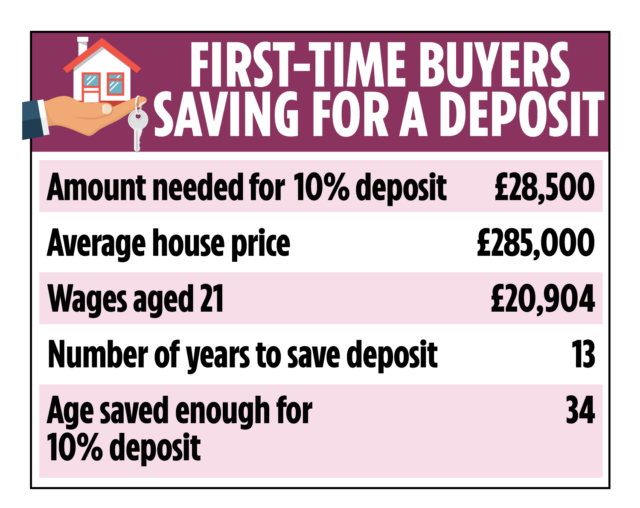

First-time buyers saving for a deposit

First-time buyers saving for a deposit

Despite our national obsession with house prices there has been a vacuum of long-term strategy in Westminster, with six housing ministers in the past year.

“The Government recognises the ambition to build more homes but has come up time and time again with planning regulations and nimbyism,” Aynsley Lammin, analyst at Investec said.

There are now fears that the housing supply could halve.

While the Government has stuck to a target of building 300,000 homes, local authorities are no longer mandated to hit targets, resulting in 56 projects already cancelled this year.

Newish red-tape around nutrient quality in rivers is also delaying around a quarter of projects.

House prices slipped by 1 per cent in May compared to the previous year.

People are finding it harder to afford a mortgage due to rising interest rates.

Mortgage costs will now be around £5,000 more expensive for a homeowner that bought in 2021 on a two-year fixed deal.

Inflation figures have added to fears that the Bank of England will raise rates above 5.5 per cent.

First-time buyers are being shut out of the market since the Government withdrew the Help to Buy and Right to Buy support in March.

It would take a 21-year-old 13 years to save for a 10 per cent deposit based on putting aside 10 per cent of their income a month, according to Interactive Investor.

Zara’s season in sun

SHOPPERS are still flocking to Zara despite the cost of living.

Spanish parent company Inditex, which also owns Bershka and Stradivarius, said sales grew by 13 per cent in the past three months to £6.5billion.

Shoppers are still flocking to Zara despite the cost of living

Shoppers are still flocking to Zara despite the cost of living

Inditex raised fashion prices by 5 per cent last year after rising costs — but there is no sign it will lower them when they fall.

Diageo’s titan Sir Ivan dies

TRIBUTES poured in yesterday after drinks firm Diageo’s boss Sir Ivan Menezes died just weeks before his retirement.

The FTSE 100 firm, maker of Guinness and Tanqueray gin, had on Monday announced a “significant setback” in Sir Ivan’s emergency surgery on a stomach ulcer.

Diageo’s boss Sir Ivan Menezes died just weeks before his retirement

Diageo’s boss Sir Ivan Menezes died just weeks before his retirement

The news saw Debra Crew’s promotion to chief executive brought forward by a month, leading many to fear the worst.

Now Sir Ivan, who joined the company in 1997, has died of complications following the surgery, aged 63.

He was called “one of the finest leaders of his generation” by chairman Javier Ferrán, who hailed Sir Ivan’s role in shaping Diageo into “one of the best-performing, most trusted and respected” of consumer firms.

Sir Ivan, born in India, had led Diageo for the last decade.

He was credited with making it the world’s largest spirits firm, via acquisitions such as George Clooney’s Casamigos brand.

Cooking on gas

THE owner of TGI Fridays claims to have saved £1million by not hedging its energy bills.

Many rival restaurant chains were locked into energy contracts when prices rocketed sixfold, but Hostmore’s decision to avoid longterm deals means it is now benefitting from falling gas prices.

Hostmore said that like-for-like sales were down three per cent across its 91 TGI Fridays restaurants so far this year but recent trading has improved.

Telegraph sale

THE DAILY and Sunday Telegraph have been put up for sale for £600million after Lloyds Bank seized control of the newspaper business from the Barclay family.

Lloyds has appointed AlixPartners as a receiver, meaning the profitable newspapers will avoid any insolvency process.

The shock move comes after Lloyds lost patience with the Barclays’ refusal to pay back a loan worth hundreds of millions of pounds.

Daily Mail owner DGMT has been tipped as a potential purchaser.

VODAFONE’S shares rose by 3 per cent yesterday after reports its long-awaited merger with Three could be announced this week.

Talks to combine the UK’s third and fourth biggest mobile phone operators would see a major shake-up of the market.

Medic cash bid

THE number of medical staff and teachers doing sales jobs for extra cash has risen by almost a fifth in a year.

In all, the Direct Selling Association, which represents brands such as Avon, Body Shop and Tupperware, reported a 36 per cent rise in people signing up to sell brands online to raise cash.

A third of new sellers work evenings and made £481 a month on average.

DSA chairman Cliff Jones said: “People are looking for ways to offset the rising cost of living in a way which is home-based.”